Are you curious about the risk associated with investing? It’s a question that often comes to mind when exploring the world of finance. Understanding the potential risks is essential for anyone considering entering the investment market. This article aims to shed light on this topic by providing historical charts and clear explanations. Additionally, we will provide reference links to popular investment broker sites to help you get started. So, if you’re eager to learn about the risks associated with investing, you’ve come to the right place!

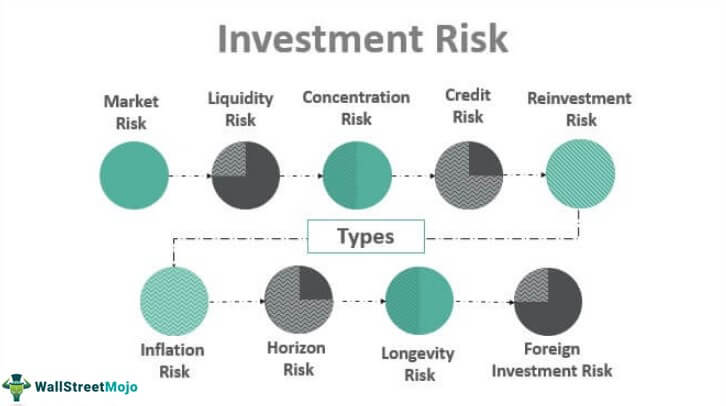

This image is property of www.wallstreetmojo.com.

Market Risk

Definition

Market risk refers to the potential for loss or negative impact on investments due to fluctuations in the overall market conditions. It encompasses various factors such as economic conditions, market volatility, investor sentiment, and geopolitical events that can affect the value of investments.

Causes

Market risk can arise from several causes. Economic factors like changes in interest rates, inflation, and unemployment can have a significant impact on the overall market sentiment. Market volatility can also be influenced by corporate earnings reports, political instability, and global events such as natural disasters or terrorist attacks. Additionally, investor behavior and market psychology, including fear and greed, can contribute to market risk.

Examples

A prime example of market risk is a stock market crash, where the value of stocks across the market declines sharply. This can result in significant losses for investors who have not adequately diversified their portfolios or failed to implement risk management strategies. Another example is the impact of economic recessions, where overall market conditions deteriorate, leading to decreased consumer spending, business failures, and subsequent effects on investments.

Mitigation

To mitigate market risk, diversification is essential. By investing in a range of asset classes such as stocks, bonds, and real estate, you can minimize the impact of market fluctuations on your portfolio. Implementing a risk management strategy, such as setting stop-loss orders or using hedging techniques, can also help limit potential losses. Staying informed about market trends and conducting thorough research before making investment decisions can give you a better understanding of market dynamics and reduce the likelihood of being caught off guard by sudden market movements.

Interest Rate Risk

Definition

Interest rate risk refers to the potential for changes in interest rates to negatively impact the value of investments. It primarily affects fixed-income securities, such as bonds, as their prices move inversely to interest rates. When interest rates rise, bond prices tend to fall, and vice versa.

Causes

Interest rate risk can be caused by various factors, including central bank policies, inflation expectations, and market demand for credit. Changes in monetary policy, such as interest rate hikes or cuts by central banks, can significantly impact the interest rates in the market. The anticipation of inflation can also influence interest rates as investors demand higher yields to compensate for the eroding purchasing power of future cash flows. Additionally, shifts in market sentiment and the supply and demand dynamics of credit can contribute to interest rate risk.

Examples

An example of interest rate risk is when bond prices decline due to an increase in market interest rates. Suppose you hold a bond with a fixed interest rate, and the market experiences a significant rise in interest rates. In that case, the value of your bond will decrease, as newly issued bonds with higher interest rates become more attractive to investors. Similarly, falling interest rates can cause bond prices to rise, providing capital gains for bondholders.

Mitigation

To mitigate interest rate risk, diversifying your fixed-income portfolio can be beneficial. Holding a combination of short-term and long-term bonds can help balance the impact of interest rate changes. Additionally, considering bonds with built-in inflation protection, such as Treasury Inflation-Protected Securities (TIPS), can provide a hedge against rising inflation. Monitoring economic indicators and staying abreast of central bank policies can also help anticipate potential changes in interest rates and adjust your investment strategy accordingly.

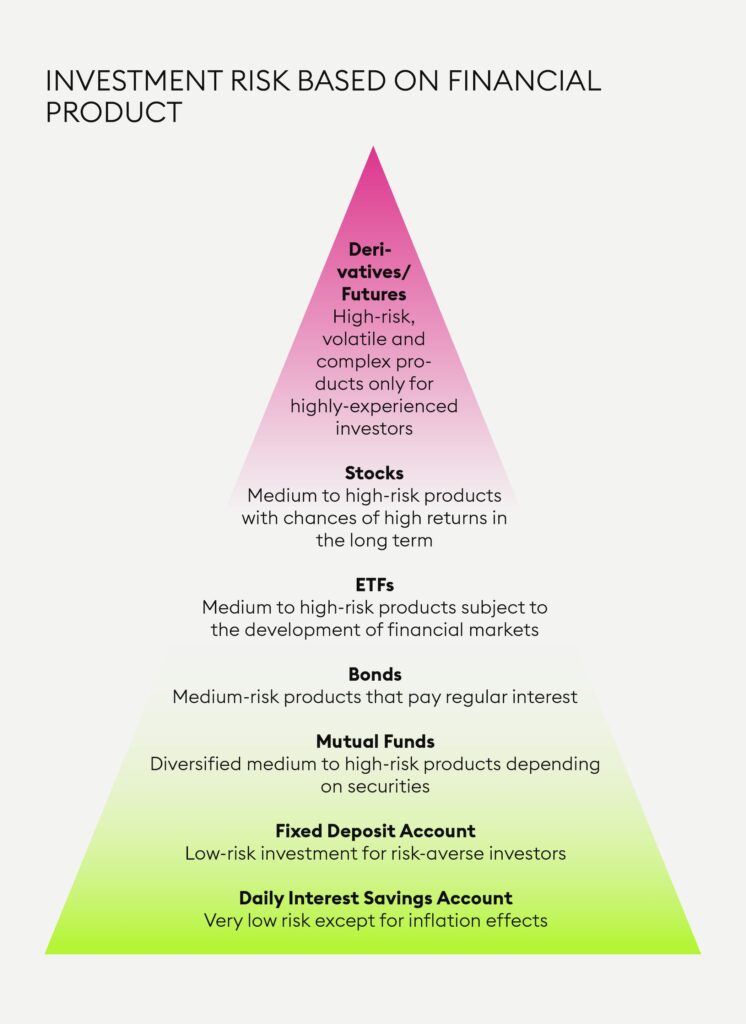

This image is property of bitpanda-academy.imgix.net.

Inflation Risk

Definition

Inflation risk refers to the potential for the purchasing power of money to decrease over time due to a persistent rise in the general level of prices. It poses challenges for investors as the returns on investments may not keep pace with inflation, resulting in a decrease in real value.

Causes

Inflation can be caused by various factors, including excessive money supply, increasing production costs, changes in consumer demand, and government fiscal policies. When the money supply grows at a faster rate than economic output, it can lead to an excess of money chasing the same amount of goods and services, causing prices to rise. Similarly, if production costs, such as wages or raw material prices, increase, businesses may pass those costs on to consumers through higher prices, contributing to inflation.

Examples

An example of inflation risk is when the annual rate of inflation exceeds the returns on certain investments. Suppose you invest in a savings account or bond that yields a fixed return of 3% annually, but the inflation rate rises to 5%. In that case, the purchasing power of your investment will erode over time, as the cost of goods and services increases faster than your returns.

Mitigation

To mitigate inflation risk, investors can consider asset classes that have historically performed well during inflationary periods. Investing in commodities such as precious metals, real estate, or inflation-protected bonds can provide a hedge against inflation. Similarly, equity investments in sectors or companies with pricing power, which can pass on increased costs to consumers, may also mitigate the impact of inflation. Regularly reviewing and adjusting your investment portfolio to account for changing economic conditions and inflation expectations is crucial in managing this risk effectively.

Credit Risk

Definition

Credit risk refers to the potential for bond issuers or borrowers to default on their debt obligations, resulting in a loss of principal or interest income for investors. It encompasses the risk of non-payment or delay in payment by individuals, corporations, or governments.

Causes

Credit risk can arise from various factors, including borrower’s financial health, industry-specific conditions, economic downturns, and changes in credit ratings. If a borrower’s financial condition deteriorates, they may be unable to meet their debt obligations, leading to default risk. Similarly, industry-specific factors, such as technological advancements or regulatory changes, can impact the creditworthiness of companies within that sector. Economic downturns can increase the likelihood of defaults across industries, as businesses face reduced revenues and financial strain. Changes in credit ratings provided by rating agencies can also impact credit risk, as downgrades indicate a higher likelihood of default.

Examples

An example of credit risk is when a company fails to make interest or principal payments on its bonds. This can result in a loss of income or even partial or total write-offs of the investment for bondholders. In extreme cases, governments might default on their sovereign debt obligations, which can have severe implications for creditors and investors holding those bonds.

Mitigation

To mitigate credit risk, diversification is crucial. Investing in a variety of bonds or fixed-income instruments from different issuers and sectors can reduce the impact of default by a single borrower. Assessing the creditworthiness of potential borrowers or issuers by analyzing their financial statements, credit ratings, and industry outlook can help identify potential risks. Investing in bonds with higher credit ratings, such as investment-grade securities, can also provide a certain level of protection against default. Periodically reviewing the creditworthiness of your portfolio holdings and staying informed about industry-specific conditions and economic indicators can aid in effectively managing credit risk.

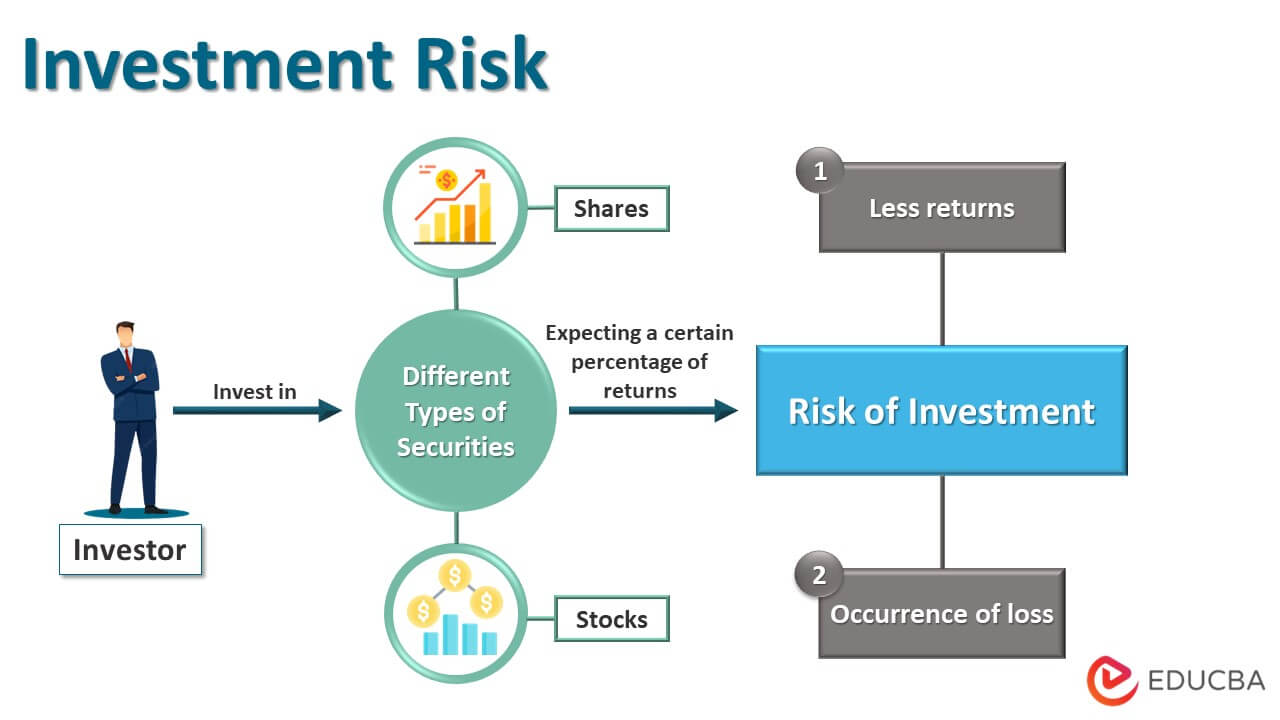

This image is property of cdn.educba.com.

Liquidity Risk

Definition

Liquidity risk refers to the potential for an investment or asset to be difficult to sell or convert into cash quickly without incurring significant losses. It arises when there is a lack of buyers or market participants willing to purchase the asset at a fair price.

Causes

Liquidity risk can be caused by several factors, including changes in market conditions, investor sentiment, and the specific characteristics of the asset itself. Market conditions, such as increased market volatility or economic uncertainty, can lead to reduced liquidity as investors become more cautious and demand for certain assets decreases. Investor sentiment can also affect liquidity, as a shift in market psychology from optimism to pessimism can lead to a lack of buyers in the market. Additionally, certain assets, such as real estate or private equity investments, may have inherent liquidity constraints due to their illiquid nature or the absence of an active secondary market.

Examples

An example of liquidity risk is when you need to sell a specific stock quickly, but there are no buyers at the current market price. In such a scenario, you may be forced to sell at a lower price, incurring a loss due to the lack of liquidity. Similarly, investments in real estate or private equity funds may require a significant time commitment to convert into cash, making them less liquid compared to publicly traded stocks or bonds.

Mitigation

To mitigate liquidity risk, it is essential to consider the liquidity characteristics of the investments you are making. Investing in assets with high trading volumes and active secondary markets can ensure easier liquidation if needed. Maintaining an appropriate cash reserve for unforeseen circumstances can also help mitigate the need for forced asset sales during periods of illiquidity. Diversification across different asset classes and regularly reviewing your investment portfolio’s liquidity profile can aid in managing liquidity risk effectively.

Country Risk

Definition

Country risk refers to the potential for political, economic, or social factors in a specific country to negatively impact investments in that country. It encompasses risks associated with government stability, regulatory changes, currency volatility, and geopolitical events.

Causes

Country risk can be caused by various factors, including political instability, changes in government policies, economic downturns, currency devaluation, and social unrest. Political instability can lead to an uncertain business environment, potential expropriation of assets, or changes in regulations that can adversely affect investments. Changes in government policies, such as taxation or trade policies, can impact the profitability and viability of businesses operating in that country. Economic downturns, currency devaluations, or hyperinflation can erode the value of investments and hinder economic growth. Geopolitical events, such as wars or terrorism, can also significantly impact investments within a country.

Examples

An example of country risk is when a government enacts new regulations or imposes restrictions on foreign investors, negatively impacting the profitability and operations of companies operating in that country. Such regulatory changes can result in decreased investor confidence and potential capital flight, further deteriorating the investment climate. Currency devaluations or economic crises can also have severe consequences for investments, as witnessed in various emerging markets in the past.

Mitigation

To mitigate country risk, it is crucial to conduct thorough research and assess the political, economic, and social conditions of a country before investing. Diversifying investments across different countries can help reduce exposure to any single country’s risk. Staying informed about geopolitical events, changes in government policies, and economic indicators can aid in anticipating potential risks and adjusting investment strategies accordingly. Consulting with international investment experts or utilizing country risk assessment tools can provide valuable insights to mitigate country-specific risks.

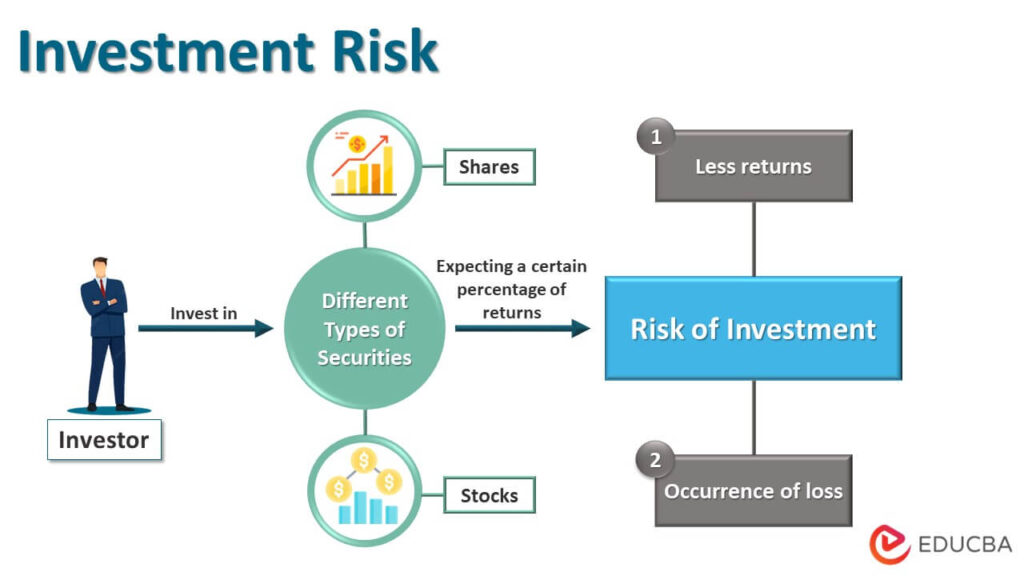

This image is property of www.wallstreetmojo.com.

Currency Risk

Definition

Currency risk refers to the potential for fluctuations in exchange rates to impact the value of investments denominated in foreign currencies. It arises when investments or assets are held in a different currency from the investor’s base currency.

Causes

Currency risk can be caused by various factors, including changes in interest rates, inflation rates, economic performance, political stability, and market expectations. Interest rate differentials between countries can lead to changes in exchange rates as investors seek higher yields in currencies with higher interest rates. Inflation differentials can also impact exchange rates, as higher inflation erodes the purchasing power of a currency and decreases its value. Economic performance and political stability play significant roles in determining currency values, as positive economic indicators and political stability can attract foreign investors, strengthening a currency. Market expectations and sentiment towards a currency can also influence its value, as speculative activities and investor sentiment can cause significant short-term fluctuations.

Examples

An example of currency risk is when you invest in foreign stocks or bonds denominated in a currency different from your base currency. If the value of the foreign currency depreciates against your base currency, the returns on your investment will be reduced when converted back to your base currency. Similarly, changes in exchange rates can also affect the profitability of multinational companies, as fluctuating currency values impact their international sales and earnings.

Mitigation

To mitigate currency risk, several strategies can be employed. One approach is to hedge currency risk by using financial instruments such as forwards, futures, options, or currency swaps to lock in exchange rates at a future date. This can provide a certain level of protection against adverse currency movements. Diversifying investments across different currencies can also help manage currency risk, as investments denominated in multiple currencies will be impacted differently by exchange rate fluctuations. Regular monitoring of exchange rates and staying informed about economic indicators, geopolitical events, and monetary policies can aid in making informed investment decisions to mitigate currency risk.

Political Risk

Definition

Political risk refers to the potential for political events or actions to negatively impact investments. It encompasses risks associated with changes in government policies, geopolitical tensions, social unrest, regulatory changes, and nationalization of assets.

Causes

Political risk can arise from various factors, including changes in government leadership, shifts in political ideologies, geopolitical conflicts, social instability, and regulatory changes. Changes in government policies, taxation, or trade regulations can have significant implications for businesses operating within a country. Geopolitical conflicts or tensions between countries can also impact investments by introducing uncertainty, affecting trade relationships, or potentially leading to military conflicts. Social unrest or protests can disrupt economic activities and investor confidence, further exacerbating political risk.

Examples

An example of political risk is when a government changes its policies or regulations related to a specific industry, significantly impacting the profitability and operations of businesses operating within that sector. This can lead to financial losses, business closures, or even complete expropriation of assets for affected companies. Geopolitical tensions between countries can also result in trade restrictions or sanctions, adversely impacting cross-border investments and trade.

Mitigation

To mitigate political risk, thorough research and analysis of the political landscape of a country are crucial before making investments. Diversifying investments across different countries can help reduce exposure to political risks within a single country. Staying informed about geopolitical events, changes in government policies, and social dynamics can aid in anticipating potential risks and adjusting investment strategies accordingly. Utilizing political risk assessment tools and consulting with experts in international affairs can provide valuable insights and guidance in managing political risk effectively.

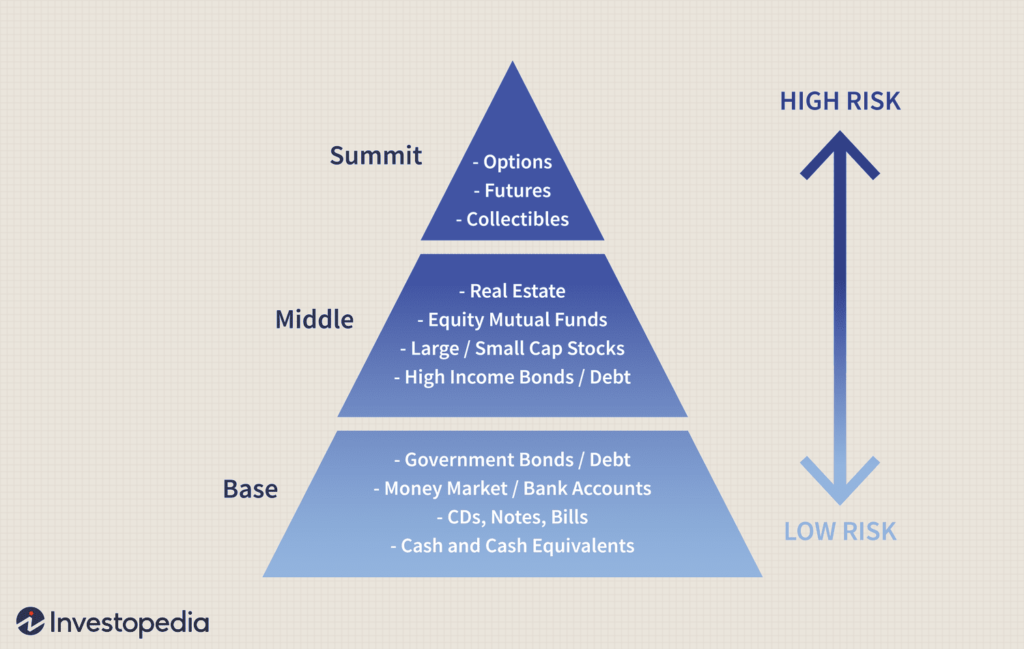

This image is property of www.investopedia.com.

Default Risk

Definition

Default risk refers to the potential for a borrower or issuer to fail to meet their debt obligations as promised, resulting in a loss of principal or interest for investors. It primarily applies to fixed-income securities such as bonds or loans.

Causes

Default risk can be caused by various factors, including financial distress, deteriorating creditworthiness, economic downturns, or changes in business conditions. If a borrower or issuer faces financial difficulties, such as declining revenues or excessive debt burdens, they may be at risk of defaulting on their debt obligations. External factors such as economic recessions can also impact a borrower’s ability to generate sufficient cash flow to meet their debt obligations. Changes in industry dynamics, technological disruptions, or shifts in consumer behavior can also render previously financially sound entities at risk of default.

Examples

An example of default risk is when a company fails to make interest payments or repay the principal amount on their bonds. Bondholders may either receive partial payments, face substantial delays in receiving payments, or even experience a total loss if the issuer becomes insolvent. Similarly, individuals who default on their loans can result in losses for lenders or investors holding those loans.

Mitigation

To mitigate default risk, conducting thorough credit analysis and assessment of potential borrowers or issuers is crucial. Assessing financial statements, credit ratings, industry outlook, and understanding the borrower’s repayment capacity can provide insights into their default risk. Diversification across different issuers, industries, and sectors can also reduce the impact of default by a single borrower. Investing in bonds with higher credit ratings and monitoring changes in credit ratings can provide additional safeguards. Staying informed about economic indicators, industry dynamics, and conducting regular credit reviews of your investment holdings can aid in managing default risk effectively.

Systematic Risk

Definition

Systematic risk, also known as undiversifiable risk or market risk, refers to the potential for market-wide factors to impact the value of investments. It cannot be eliminated through diversification and affects the entire market or a particular segment of it.

Causes

Systematic risk can be caused by factors that impact the overall economy or market, such as changes in interest rates, inflation, political events, natural disasters, or economic recessions. These factors affect a broad range of investments and cannot be attributed to company-specific or industry-specific circumstances. Systematic risk is inherent in the market itself and affects all investors to some extent.

Examples

Examples of systematic risk include stock market crashes, economic recessions, or global events such as the COVID-19 pandemic. During a stock market crash, the value of stocks across various sectors declines, reflecting broad market sentiment and economic conditions. Economic recessions lead to reduced consumer spending, business failures, and overall market downturns. Global events such as natural disasters or geopolitical tensions can also create widespread market volatility and impact investments across multiple sectors and countries.

Mitigation

Due to its nature, systematic risk cannot be completely eliminated. However, prudent risk management strategies can help mitigate its impact. Diversification across different asset classes, sectors, and geographical regions can minimize the effect of systematic risk on a portfolio. Regularly reviewing and rebalancing your investment holdings can help adjust your exposure to different market segments or asset classes. Employing risk management techniques such as stop-loss orders or utilizing derivative instruments tailored for risk hedging purposes can provide some level of protection during periods of market instability. Staying informed about market trends, economic indicators, and global events can aid in anticipating potential systematic risks and adjusting your investment strategy accordingly.