So you’re ready to take the leap into the world of investing, but where do you start? With so many options and strategies out there, it can feel overwhelming. But fear not, because we’re here to guide you towards the best way to begin your investment journey. In this article, we’ll provide you with historical charts and clear explanations to help you gain a better understanding of the subject. Additionally, we’ll provide reference links to popular investment broker sites, making it easier for you to dive right in and start investing. So let’s explore the best way to start investing and set you on the path to financial success.

This image is property of www.clevergirlfinance.com.

Determining Financial Goals

Defining short-term and long-term goals

When it comes to determining your financial goals, it’s important to first define what you’re hoping to achieve in both the short and long term. Short-term goals typically cover things you want to accomplish within the next few years, such as purchasing a car or saving for a down payment on a house. Long-term goals, on the other hand, are usually focused on retirement or funding your children’s education. By clearly identifying your goals, you’ll be able to develop a financial plan that aligns with your aspirations.

Analyzing risk appetite

While setting financial goals is important, it’s equally crucial to assess your risk appetite. This refers to your willingness to take on risks in order to achieve those goals. Are you comfortable with a more aggressive investment strategy that has the potential for higher returns but also carries a higher level of risk? Or would you prefer a more conservative approach that prioritizes capital preservation? Understanding your risk appetite will help guide your investment decisions and ensure that you stay within your comfort zone.

Considering time horizon

Another factor to consider when determining your financial goals is your time horizon. This refers to the length of time you have to achieve your objectives. Short-term goals typically have a shorter time horizon, while long-term goals have a longer one. The time horizon plays a critical role in investment decisions because it determines the level of risk you can afford to take. Generally, investments with a longer time horizon can withstand short-term market fluctuations and have a higher potential for growth. On the other hand, if you have a shorter time horizon, it may be more prudent to focus on investments with lower volatility and higher liquidity.

Building an Emergency Fund

Understanding the importance of an emergency fund

Creating an emergency fund is a vital step in achieving financial stability. An emergency fund is a pool of money set aside to cover unexpected expenses or income loss. Life is full of uncertainties, such as medical emergencies, car repairs, or periods of unemployment. Without an emergency fund, you may be forced to turn to high-interest debt or liquidate investments to cover these expenses, which can have long-lasting negative effects on your financial health. By having an emergency fund, you can handle such situations without derailing your long-term financial goals.

Calculating the ideal amount

Determining the ideal amount for your emergency fund depends on several factors, such as your monthly expenses, job stability, and risk tolerance. As a general rule of thumb, financial experts recommend setting aside three to six months’ worth of living expenses in your emergency fund. This amount should be able to cover essential costs like rent/mortgage, utilities, groceries, and loan payments. However, if you have dependents or work in an unstable industry, you may want to aim for a larger emergency fund to provide a greater sense of security.

Choosing a savings account

When building an emergency fund, it’s crucial to choose the right type of savings account. Look for an account that offers a competitive interest rate and easy accessibility. While traditional savings accounts provide a safe and secure option, their interest rates tend to be lower. Consider exploring high-yield savings accounts, which offer higher interest rates and can help grow your emergency fund more quickly. Keep in mind that the ideal savings account should strike a balance between accessibility and growth potential.

This image is property of m.foolcdn.com.

Paying off High-Interest Debt

Assessing and prioritizing debt

Before diving into investing, it’s essential to assess your existing debts and prioritize paying off any high-interest debt, such as credit card debt or personal loans. High-interest debt can quickly accumulate and hinder your ability to grow your wealth. Take a close look at your debts, their interest rates, and minimum monthly payments. Start by paying off the debt with the highest interest rate while making minimum payments on the others. Once the first debt is paid off, redirect the payments towards the next highest interest rate debt until all high-interest debt is eliminated.

Creating a repayment plan

To effectively pay off high-interest debt, it’s important to create a repayment plan. Start by reviewing your budget and identifying areas where you can cut back on expenses. By freeing up more money to put towards debt payments, you’ll be able to accelerate your repayment process. Consider utilizing a debt repayment strategy like the snowball method or avalanche method, which focus on paying off debts systematically and efficiently. Stick to your repayment plan consistently, and be sure to celebrate each milestone along the way.

Exploring debt consolidation options

If you find yourself juggling multiple high-interest debts, it may be worth exploring debt consolidation options. Debt consolidation involves combining multiple debts into a single loan or credit card with a lower interest rate. This can simplify your repayment process and potentially save you money on interest payments. Balance transfer credit cards, personal loans, or home equity loans are common methods of debt consolidation. However, it’s important to carefully consider the terms and fees associated with these options and ensure that they align with your financial goals.

Educating Yourself about Investments

Understanding different asset classes

Before you start investing, it’s crucial to have a basic understanding of different asset classes. Asset classes refer to the different types of investments available, such as stocks, bonds, real estate, and commodities. Each asset class comes with its own characteristics, risk levels, and potential returns. Stocks, for example, represent ownership in a company and offer the potential for capital appreciation. Bonds, on the other hand, are debt instruments that provide fixed income but usually entail lower risk than stocks. By familiarizing yourself with different asset classes, you can make informed investment decisions that align with your goals and risk tolerance.

Researching investment options

Once you have a grasp of different asset classes, it’s time to research specific investment options within those categories. This includes reading about individual companies, mutual funds, exchange-traded funds (ETFs), and other investment vehicles. Look for information on historical performance, management expertise, fees, and any potential risks associated with the investment. Popular financial websites and reputable brokerage firms often provide comprehensive research and analysis tools to help you evaluate investment options. Taking the time to research and compare different options can greatly enhance your investment knowledge and increase the likelihood of making sound investment decisions.

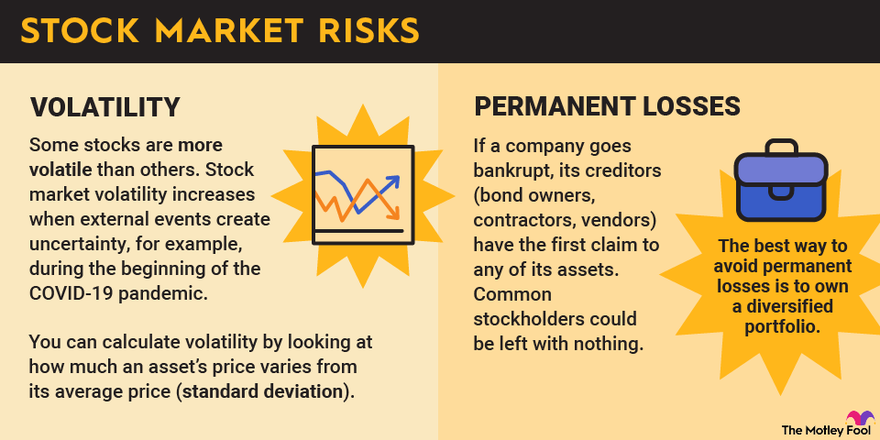

Learning about risk and return

Investing inherently involves risks, and understanding the relationship between risk and return is crucial. Generally, investments with higher potential returns also carry higher levels of risk. Conversely, investments with lower risk typically offer lower potential returns. Assessing your risk tolerance will help guide your investment decisions and determine the appropriate balance between risk and return. It’s important to note that risk tolerance may vary depending on your age, financial stability, and investment goals. Educating yourself about different types of risk, such as market risk and inflation risk, will help you navigate the investment landscape more confidently.

This image is property of qph.cf2.quoracdn.net.

Utilizing Retirement Accounts

Exploring employer-sponsored plans (401(k), 403(b))

One of the most common ways to save for retirement is through employer-sponsored plans, such as a 401(k) or 403(b) plan. These retirement accounts allow you to contribute a portion of your pre-tax income, which can significantly reduce your taxable income. Many employers also offer matching contributions, where they match a percentage of your contributions up to a certain limit. These matching contributions are essentially free money and can greatly enhance the growth of your retirement savings. Take advantage of these plans by contributing the maximum allowed to fully capitalize on the employer match and enjoy potential tax advantages.

Considering Individual Retirement Accounts (IRAs)

In addition to employer-sponsored plans, Individual Retirement Accounts (IRAs) provide another option for retirement savings. IRAs come in two main types: traditional and Roth. Traditional IRAs offer tax-deferred contributions, meaning you can deduct the amount contributed from your taxable income. However, withdrawals in retirement are taxed as ordinary income. On the other hand, Roth IRAs involve contributing after-tax money, but withdrawals in retirement are tax-free. IRAs provide greater flexibility and control over your retirement savings, and contributions can be made even if you don’t have access to an employer-sponsored plan.

Maximizing contribution limits

To make the most of your retirement savings, it’s important to maximize your contribution limits. These limits dictate the maximum amount you can contribute to retirement accounts each year. For 2021, the contribution limit for 401(k) and 403(b) plans is $19,500 for individuals under 50 years old, with a catch-up contribution option of an additional $6,500 for those 50 and older. The annual contribution limit for IRAs is $6,000 for individuals under 50, with a catch-up contribution of an additional $1,000 for those 50 and older. By contributing the maximum allowed, you’ll give yourself the best chance of building a substantial retirement nest egg.

Diversifying Your Portfolio

Understanding the benefits of diversification

Diversifying your investment portfolio is essential for managing risk and maximizing potential returns. Diversification involves spreading your investments across different asset classes, industries, and geographic regions. By doing so, you reduce the impact of any single investment’s performance on your overall portfolio. Diversification allows you to potentially benefit from the outperformance of certain investments while minimizing the negative impact of underperforming ones. This strategy helps smooth out volatility and provides a better chance of achieving consistent growth over the long term.

Allocating investments across different assets

To effectively diversify your portfolio, it’s important to allocate investments across different asset classes. Consider including a mix of stocks, bonds, real estate, and other assets based on your risk tolerance and investment goals. The allocation of investments should align with your time horizon and risk appetite. Younger investors with a longer time horizon may allocate a higher percentage of their portfolio to stocks, while those closer to retirement may prefer a more conservative allocation with a higher proportion of bonds. Regularly reassess your asset allocation and make adjustments as needed to ensure it remains in line with your objectives.

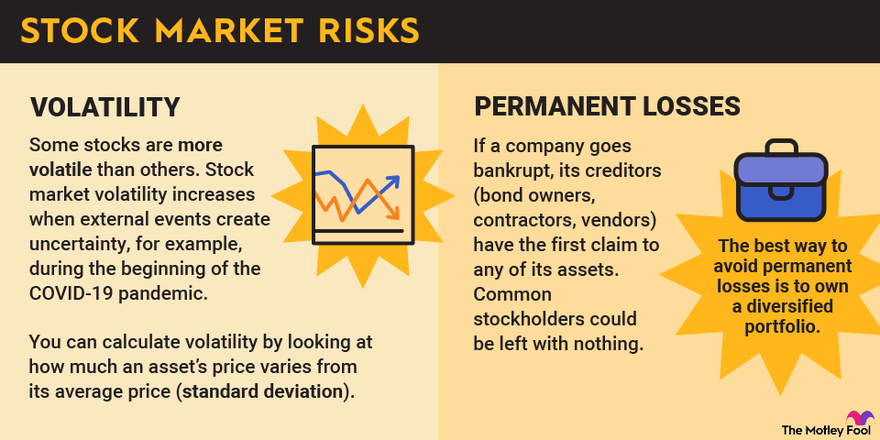

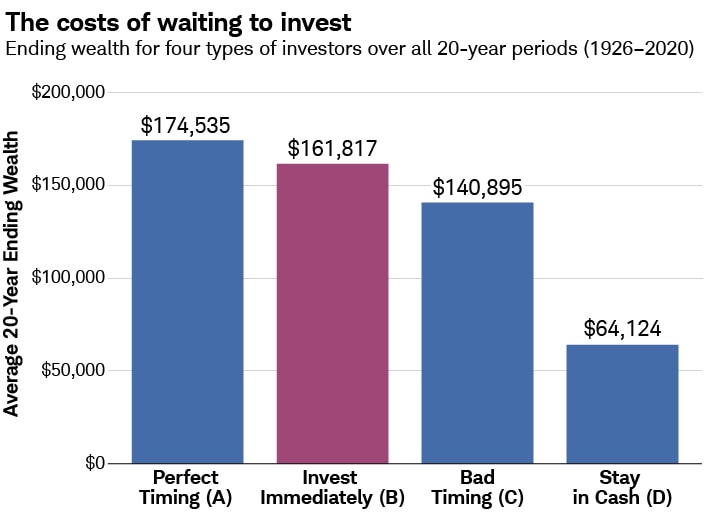

Rebalancing periodically

To maintain an optimal level of diversification, it’s necessary to rebalance your portfolio periodically. Rebalancing involves adjusting your asset allocation back to your desired target percentages. As certain investments outperform or underperform others, your portfolio’s allocation can drift away from the original plan. Rebalancing allows you to sell investments that have become overweighted and buy those that have become underweighted. This disciplined approach forces you to consistently buy low and sell high, promoting the buy and hold strategy that has historically been successful for long-term investors.

This image is property of www.schwab.com.

Choosing an Investment Broker

Researching reputable brokerage firms

Choosing a reputable investment broker is crucial for a successful investment journey. Take the time to research different brokerage firms and their reputations. Look for firms that have a solid track record, excellent customer reviews, and a strong financial standing. Research the firm’s history, the services they offer, and any fees associated with their platforms or accounts. Reputable brokerage firms often have user-friendly websites and educational resources to help beginner investors navigate the investment landscape.

Comparing fees and commissions

When selecting an investment broker, it’s important to compare fees and commissions. Different brokerage firms have different fee structures, and these fees can significantly impact your investment returns over time. Pay close attention to trading fees, account maintenance fees, and any other charges that may apply. Some brokerage firms offer commission-free trades or lower fees for certain types of investments, such as ETFs. Consider your investment strategy and expected trading frequency when evaluating the potential impact of fees on your investment returns.

Considering user-friendly platforms

Investing can seem complex and overwhelming, especially for beginners. Choosing an investment broker with a user-friendly platform can make the process much smoother and more enjoyable. Look for platforms that offer intuitive interfaces, easy-to-understand investment options, and educational resources. Many brokerage firms provide demo accounts or virtual trading platforms that allow you to practice investing with virtual money. This can be a valuable tool for gaining confidence and familiarizing yourself with the mechanics of investing before risking real money.

Beginner-friendly Investment Options

Exploring index funds and ETFs

For beginner investors, index funds and exchange-traded funds (ETFs) are excellent investment options. These funds offer a diversified portfolio of stocks or bonds that aim to replicate the performance of a specific market index, such as the S&P 500. Index funds and ETFs provide instant diversification and are passively managed, meaning they aim to match the index’s performance rather than actively selecting individual stocks. As a result, they tend to have lower expense ratios compared to actively managed funds. Consider investing in index funds or ETFs that align with your investment goals and risk tolerance.

Considering robo-advisors

Robo-advisors are another beginner-friendly investment option that leverages technology to provide automated investment management services. These platforms use algorithms to build and manage diversified portfolios based on your investment goals and risk tolerance. Robo-advisors typically have low minimum investment requirements and charge lower fees compared to traditional human financial advisors. They provide a hands-off approach to investing, making them ideal for beginners who may not have the time or expertise to manage their own portfolios.

Starting with low-cost stocks

For those with an interest in individual stocks, starting with low-cost stocks is a wise approach. Low-cost stocks, also known as penny stocks, are shares of companies that trade at a relatively low price. While they may carry higher risks, they can also offer the potential for significant returns. Investing in low-cost stocks allows beginner investors to gain experience in buying and selling individual stocks without committing a substantial amount of capital. However, it’s crucial to conduct thorough research and exercise caution, as penny stocks can be volatile and vulnerable to manipulation.

This image is property of www.easypeasyfinance.com.

Creating an Investment Plan

Creating a budget and setting aside investable funds

Before diving into investing, it’s important to create a budget that reflects your income, expenses, and financial goals. A budget serves as a roadmap for your finances and provides a clear picture of how much money you can allocate towards investments. By identifying areas where you can cut back on expenses, you can free up more funds for investing. It’s crucial to strike a balance between investing and saving for short-term needs or emergencies. Set aside a specific amount of money each month that you can comfortably invest without compromising your financial stability.

Establishing an investment timeline

An investment timeline refers to the length of time you plan to hold your investments. It’s important to establish a realistic investment timeline that aligns with your financial goals. Are you investing for retirement that is several decades away, or are you saving for a shorter-term goal like a down payment on a house? Understanding your investment timeline will guide your asset allocation and the types of investments you choose. Stocks, for example, tend to be more volatile in the short term but have historically provided higher returns over longer periods. Define your investment timeline to ensure your investment plan is well-suited to your goals.

Determining asset allocation

Asset allocation refers to how your investments are divided among different asset classes, such as stocks, bonds, and cash. Determining the appropriate asset allocation is a crucial part of creating an investment plan. Asset allocation should be personalized based on your risk tolerance, time horizon, and investment goals. Younger investors with a longer time horizon may opt for a higher allocation to stocks, while those closer to retirement may prefer a more conservative allocation with a higher proportion of bonds. Regularly reassess your asset allocation as your circumstances change to ensure it remains aligned with your objectives.

Seeking Professional Guidance

Considering financial advisors

While it’s possible to navigate the investment landscape independently, seeking professional guidance from a financial advisor can provide valuable expertise and peace of mind. Financial advisors can help you develop a comprehensive investment plan tailored to your unique financial situation and goals. They can provide insights into different investment options, help you navigate complex financial regulations, and provide ongoing support and advice. When selecting a financial advisor, look for someone with the appropriate credentials, a fiduciary duty to act in your best interest, and a clear understanding of your financial goals.

Requesting personalized investment advice

Working with a financial advisor allows you to receive personalized investment advice based on your individual circumstances. A financial advisor can analyze your financial goals, risk tolerance, and time horizon to develop a custom investment strategy. They can help you identify suitable investments, diversify your portfolio, and optimize your asset allocation. By leveraging their expertise, you can make informed decisions and potentially avoid costly mistakes. Regularly consult with your financial advisor to discuss any changes in your goals or financial situation and to ensure your investment plan remains on track.

Keeping abreast of changes in financial regulations

Financial regulations and policies can have a significant impact on the investment landscape. As an investor, it’s important to stay informed about any changes in regulations that may affect your investment strategy. For example, tax laws, retirement account contribution limits, or new investment products can all impact your financial plan. Stay updated by following reputable financial news sources, attending seminars or webinars, and engaging with your financial advisor. By staying informed, you can adapt your investment plan accordingly and make the most of the opportunities available to you.

In conclusion, starting your investment journey requires careful consideration of your financial goals, risk appetite, and time horizon. By determining your goals, building an emergency fund, paying off high-interest debt, educating yourself about investments, utilizing retirement accounts, diversifying your portfolio, choosing the right investment broker, exploring beginner-friendly options, creating a comprehensive investment plan, seeking professional guidance when needed, and staying informed about financial regulations, you can set yourself up for success in the world of investing. Remember, investing is a long-term commitment, and it’s important to monitor and adjust your investment strategy as needed to stay on track towards achieving your financial aspirations. Happy investing!