Are you wondering about the tax implications of your investments? It’s a common concern among investors like yourself. Luckily, we’ve got you covered. In this article, we’ll provide you with insightful information about the tax implications of your investments. We’ll break down complex concepts with easy-to-understand explanations and present historical charts to help you visualize these implications. Additionally, we’ll even provide reference links to popular investment broker sites, making it easier for you to start your investment journey. So, let’s dive in and explore what you need to know about the tax implications of your investments!

This image is property of fastercapital.com.

Overview of Tax Implications

Understanding tax implications

When it comes to investing, it’s important to understand the tax implications of your investments. Tax implications refer to how your investments are treated for tax purposes and can have a significant impact on your overall investment returns. By understanding the tax implications, you can make more informed investment decisions and potentially maximize your after-tax returns.

Why tax implications matter

Tax implications matter because they directly affect your investment returns. Different types of investment income and accounts are subject to different tax rates and rules, and understanding these implications can help you minimize your tax liability and keep more of your hard-earned money. It’s important to consider tax implications when choosing investment vehicles and strategies, as they can impact your net investment income and overall financial goals.

Taxable vs. Tax-Advantaged Accounts

Different types of investment accounts

Investment accounts can be broadly classified into two categories: taxable and tax-advantaged accounts. Taxable accounts include individual brokerage accounts, where you hold investments in your own name and pay taxes on any income or gains generated from those investments. On the other hand, tax-advantaged accounts, such as individual retirement accounts (IRAs) and 401(k) plans, offer certain tax benefits that can help minimize your tax liability.

Tax implications of taxable accounts

In taxable accounts, you are responsible for paying taxes on any investment income generated. This includes interest income, dividends, and capital gains. The tax rates for these types of income depend on your income tax bracket and the holding period of the investment. Short-term capital gains, which are realized from investments held for one year or less, are subject to higher tax rates compared to long-term capital gains, which are from investments held for more than one year.

Tax advantages of tax-advantaged accounts

Tax-advantaged accounts offer several advantages when it comes to taxes. Contributions made to these accounts may be tax-deductible, reducing your taxable income in the year the contribution is made. Additionally, any growth or income generated within these accounts is tax-deferred, meaning you won’t owe taxes on these gains until you withdraw the funds in retirement. Depending on the type of tax-advantaged account, withdrawals in retirement may be subject to ordinary income tax rates, which are typically lower than the tax rates during your working years. Overall, tax-advantaged accounts can help you save on taxes both now and in the future.

This image is property of fastercapital.com.

Capital Gains and Dividends

What are capital gains?

Capital gains refer to the increase in value of an investment over time. When you sell an investment for a profit, the difference between the purchase price and the sale price is considered a capital gain. On the other hand, if you sell an investment for less than what you paid for it, resulting in a loss, it is considered a capital loss.

How capital gains are taxed

Capital gains are taxed differently depending on how long you held the investment. If you held the investment for one year or less, it is considered a short-term capital gain and is subject to ordinary income tax rates. However, if you held the investment for more than one year, it is considered a long-term capital gain and eligible for lower tax rates. The tax rates for long-term capital gains vary based on your income level, with lower rates applied to individuals in lower tax brackets.

Tax considerations for dividends

Dividends are payments that companies make to their shareholders out of their profits. They can be classified as either qualified or non-qualified dividends, and the tax implications differ for each. Qualified dividends are subject to the same tax rates as long-term capital gains, meaning they are generally taxed at lower rates. Non-qualified dividends, on the other hand, are taxed at ordinary income tax rates. It’s important to consider these tax implications when investing in dividend-paying stocks, as it can impact your after-tax returns.

Taxation of Interest Income

Different types of interest income

Interest income can come from various sources, such as bonds, savings accounts, or certificates of deposit (CDs). Each type of interest income may have different tax implications, so it’s important to understand how the income is treated for tax purposes.

Taxation of interest income from bonds

Interest income from bonds is generally subject to federal and state income taxes. The specific tax rate depends on your income tax bracket. However, certain types of bonds, such as municipal bonds issued by state and local governments, may be exempt from federal income taxes. Additionally, if you live in the state where the bond was issued, you may also benefit from state tax exemptions.

Tax implications of interest income from savings accounts

Interest income from savings accounts is also subject to federal and state income taxes. The tax rate is based on your income tax bracket. However, interest earned from savings accounts is typically lower compared to other types of investments, so the tax impact may be minimal, especially for individuals in lower tax brackets.

This image is property of enterslice.com.

Tax-Efficient Investing Strategies

Utilizing tax-efficient investment vehicles

Tax-efficient investment vehicles, such as index funds or exchange-traded funds (ETFs), can help minimize your tax liability. These investment vehicles are designed to track a specific market index and have low turnover, which reduces the number of taxable events and potentially lowers your tax liability. Additionally, these funds often distribute capital gains in a tax-efficient manner, helping you maximize after-tax returns.

Considerations for tax loss harvesting

Tax loss harvesting is a strategy used to offset capital gains with capital losses. By selling investments that have experienced a loss, you can use those losses to offset any gains you may have realized and potentially reduce your overall tax liability. It’s important to be aware of the wash-sale rule, which prohibits you from buying back the same or substantially identical security within 30 days of selling it, as it can negate the tax benefits of the loss.

Strategies to minimize taxable income

There are several strategies you can employ to minimize your taxable income. One option is to invest in tax-advantaged accounts, such as IRAs or 401(k)s, which offer tax benefits. Additionally, you can focus on investments that generate tax-efficient income, such as qualified dividends or long-term capital gains. Finally, you can carefully manage your investment portfolio to minimize taxable events, such as limiting unnecessary buying and selling.

IRA and 401(k) Contributions

Overview of IRAs and 401(k)s

IRAs and 401(k)s are retirement savings accounts that offer tax advantages. IRAs can be opened by individuals, while 401(k)s are employer-sponsored retirement plans. Both accounts allow you to contribute pre-tax dollars, reducing your taxable income in the year of contribution.

Tax advantages of IRA and 401(k) contributions

Contributions to traditional IRAs and 401(k)s are tax-deductible, meaning they reduce your taxable income in the year the contribution is made. Additionally, any growth or income within these accounts is tax-deferred. This means you won’t owe taxes on the gains until you withdraw the funds in retirement, potentially allowing your investments to grow more quickly. Roth IRAs and Roth 401(k)s, on the other hand, offer tax-free withdrawals in retirement, as contributions are made with after-tax dollars.

Limits and eligibility criteria

There are limits and eligibility criteria for contributing to IRAs and 401(k)s. The limits vary depending on your age and income. For IRAs, there are annual contribution limits, and individuals over the age of 50 may be eligible for catch-up contributions. 401(k) contribution limits are set each year by the IRS and may be subject to employer matching contributions. It’s important to understand these limits and criteria to ensure you maximize your contributions while staying within the guidelines.

This image is property of fastercapital.com.

Required Minimum Distributions (RMDs)

What are RMDs?

Required Minimum Distributions (RMDs) are the minimum amounts that individuals must withdraw from their retirement accounts once they reach a certain age. This age is typically 72 for most retirement accounts, although there are certain exceptions for individuals born before a certain date.

Tax implications of RMDs

RMDs are subject to ordinary income tax rates, which means you’ll be taxed based on your income tax bracket in the year of withdrawal. Failing to take the required minimum distributions can result in significant penalties, so it’s important to understand the rules and take your RMDs on time to avoid any unnecessary tax liability.

Strategies for managing RMDs

There are several strategies you can employ to help manage your RMDs. One option is to consider converting a traditional IRA to a Roth IRA before reaching the RMD age. This allows you to pay taxes on the converted amount at current tax rates, potentially reducing future tax liability. Additionally, you can strategically plan your withdrawals to minimize the impact on your tax bracket and overall tax liability.

Qualified vs. Non-Qualified Dividends

Difference between qualified and non-qualified dividends

The difference between qualified and non-qualified dividends lies in how they are taxed. Qualified dividends are dividends that meet certain requirements set by the IRS, such as being paid by a U.S. corporation or qualifying foreign corporation. Non-qualified dividends, on the other hand, do not meet these requirements.

Tax treatment of qualified dividends

Qualified dividends are taxed at lower capital gains tax rates, which are typically lower than ordinary income tax rates. The tax rate for qualified dividends depends on your income level and filing status. By investing in companies that pay qualified dividends, you can potentially lower your overall tax liability on investment income.

Tax implications of non-qualified dividends

Non-qualified dividends are taxed at ordinary income tax rates, which are generally higher compared to the tax rates for qualified dividends and long-term capital gains. It’s important to consider these tax implications when investing in dividend-paying stocks, as the type of dividend can impact your after-tax returns.

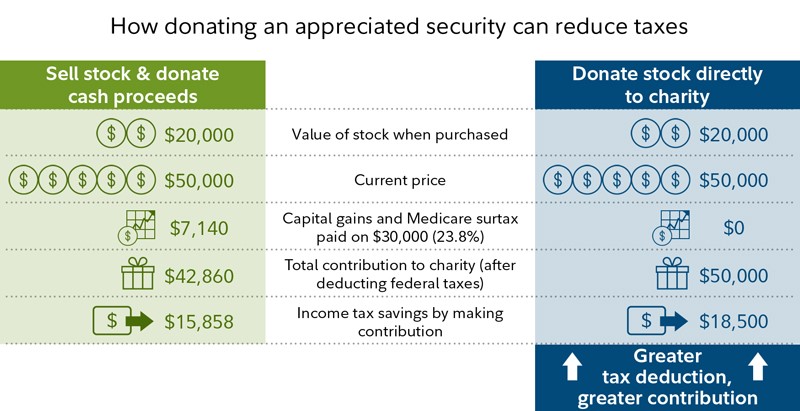

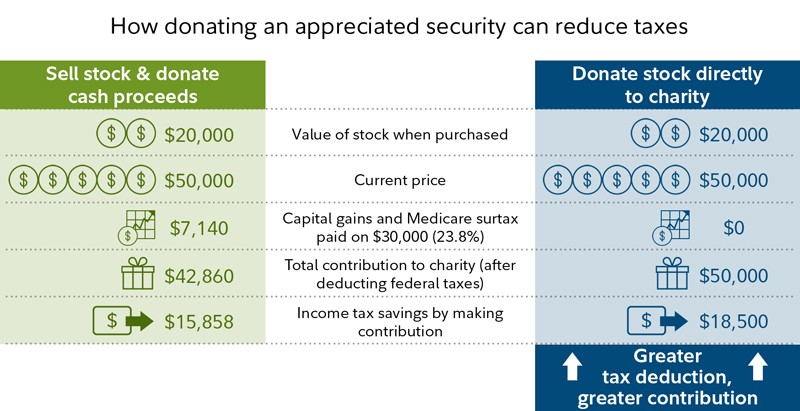

This image is property of www.fidelity.com.

Tax Implications of Real Estate Investments

Tax considerations for rental income

If you invest in real estate and earn rental income, it’s important to understand the tax implications. Rental income is generally considered taxable income and is subject to federal and state income taxes. However, there are certain deductions and depreciation allowances that can help offset the tax liability associated with rental income. It’s important to keep detailed records of expenses and consult with a tax professional to ensure you are maximizing your deductions while complying with tax laws.

Capital gains tax on real estate

When you sell a real estate investment for a profit, you may be subject to capital gains tax. The tax rate depends on how long you held the property and your income level. If you held the property for more than one year, it may qualify for long-term capital gains tax rates, which are generally lower than ordinary income tax rates. It’s important to consult with a tax professional to understand the specific tax implications of your real estate investments.

1031 exchanges for deferring taxes

A 1031 exchange, also known as a like-kind exchange, allows you to defer paying capital gains taxes on the sale of investment property if you reinvest the proceeds into a similar property. This can be a valuable strategy for real estate investors who are looking to sell a property and reinvest the proceeds without incurring immediate tax liability. It’s important to follow the specific rules and guidelines set by the IRS to qualify for a 1031 exchange.

Seeking Professional Advice

Importance of consulting a tax professional

Navigating the tax implications of your investments can be complex, and it’s important to consult with a qualified tax professional. A tax professional can help you understand the specific tax rules and regulations that apply to your situation, ensuring that you are maximizing your deductions and minimizing your tax liability. They can also provide guidance on tax-efficient investment strategies and assist with tax planning to help you meet your financial goals.

Working with a financial advisor

In addition to consulting a tax professional, working with a financial advisor can provide valuable guidance when it comes to managing your investments and minimizing tax implications. A financial advisor can help you develop a tax-efficient investment plan tailored to your specific needs and goals. They can also provide ongoing portfolio management and monitor tax implications as market conditions and tax laws change.

Resources for finding tax professionals

If you’re in need of a tax professional, there are several resources available to help you find the right one. Online directories, such as the National Association of Tax Professionals or the American Institute of Certified Public Accountants, can provide a list of qualified tax professionals in your area. Additionally, personal recommendations from friends, family, or other trusted sources can be a helpful way to find a tax professional you feel comfortable working with. Taking the time to find a qualified tax professional can provide peace of mind and ensure that you are receiving accurate and reliable tax advice.