Are you feeling overwhelmed with choosing the right investment advisor or financial planner? Don’t worry, we’ve got you covered! In this article, we will provide you with historical charts and clear explanations to help you navigate the decision-making process. Additionally, we will provide reference links for popular investment broker sites to get you started on your investment journey. So sit back, relax, and let us guide you in finding the perfect advisor or planner for your financial goals.

This image is property of d269azu04l8n6x.cloudfront.net.

Identify Your Financial Goals and Needs

Define Your Short-Term and Long-Term Goals

When it comes to choosing the right investment advisor or financial planner, it is crucial to identify your financial goals. Start by separating your goals into short-term and long-term categories. Short-term goals may include saving for a vacation, paying off debt, or establishing an emergency fund. Long-term goals, on the other hand, might involve retirement planning, buying a house, or funding your child’s education.

By clearly defining these goals, you will have a better understanding of the expertise you require from an advisor. Some advisors specialize in certain areas like retirement planning or estate planning, while others offer a comprehensive range of services to address all your financial needs.

Assess Your Risk Tolerance

Understanding your risk tolerance is another essential aspect of choosing the right investment advisor or financial planner. Risk tolerance refers to your ability and willingness to handle fluctuations in the value of your investments. It is crucial to consider how comfortable you are with the potential for market volatility and the possibility of losing some or all of your invested capital.

An experienced advisor will take the time to assess your risk tolerance through discussions and questionnaires. By understanding your risk tolerance, they can recommend investment strategies that align with your comfort level and long-term financial goals.

Determine Your Financial Planning Needs

Before selecting an investment advisor or financial planner, it is essential to determine the specific financial planning needs you have. Do you require assistance with retirement planning, tax optimization, estate planning, or a combination of different services? Evaluating your financial planning needs will help you narrow down the choices and find an advisor who specializes in areas that are most relevant to you.

Understand Different Types of Advisors

Differentiate Between Investment Advisors and Financial Planners

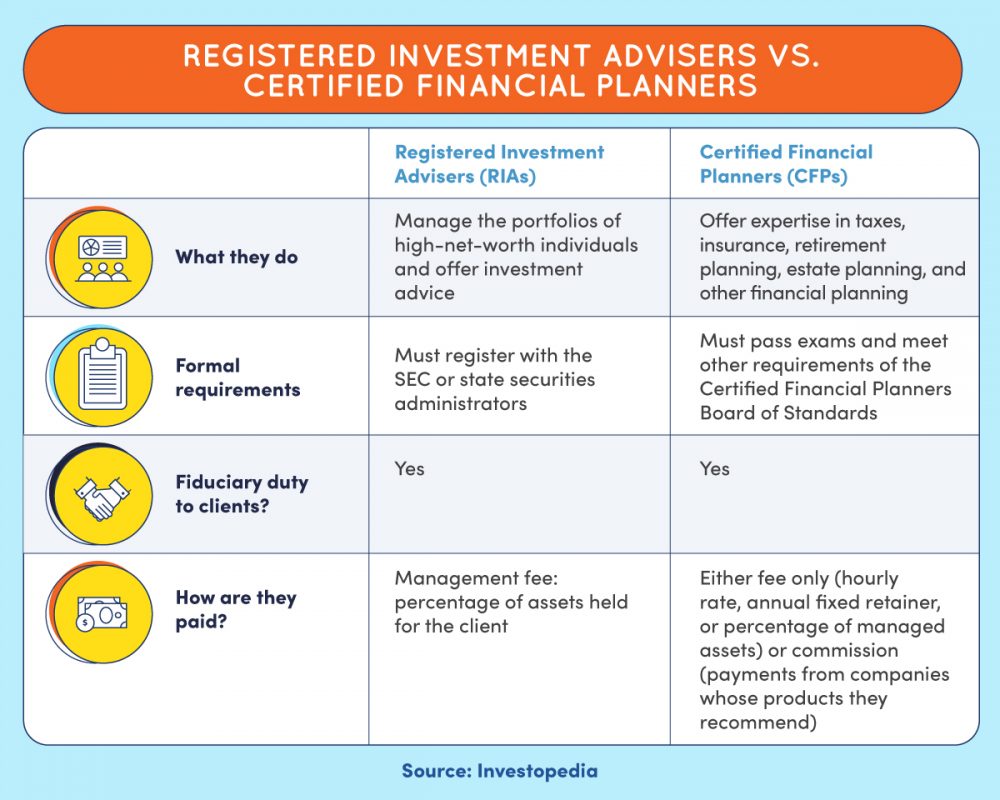

When exploring the world of investment advisors and financial planners, it is crucial to understand the differences between the two. Investment advisors primarily focus on managing investments and helping clients develop investment portfolios. They provide guidance and recommendations for buying and selling stocks, bonds, mutual funds, and other investment vehicles.

On the other hand, financial planners offer a more holistic approach to managing personal finances. They take into account various aspects such as retirement planning, tax strategies, estate planning, insurance, and risk management. Financial planners work with clients to create comprehensive financial plans that align with their goals and ensure their overall financial well-being.

Know the Distinction Between Registered Investment Advisors (RIAs) and Brokers

Registered Investment Advisors (RIAs) and brokers are two distinct types of professionals. RIAs are held to a fiduciary standard, which means they have a legal and ethical obligation to act in the best interests of their clients. They are required to provide transparent and unbiased advice.

On the other hand, brokers typically work for brokerage firms and operate under a suitability standard. This standard means that they must recommend investments that are suitable for their clients based on factors such as age, risk tolerance, and investment objectives. Brokers may receive commissions or bonuses for selling certain investment products, which can create potential conflicts of interest.

Understanding the difference between RIAs and brokers is crucial when choosing an investment advisor or financial planner. Consider whether you prefer an advisor who is legally bound to act in your best interest or if you are comfortable with a suitability standard.

This image is property of www.pvagllc.com.

Research Credentials and Qualifications

Look for Certified Financial Planner (CFP) Designation

One of the essential credentials to look for when choosing an investment advisor or financial planner is the Certified Financial Planner (CFP) designation. The CFP certification is awarded to professionals who have completed extensive education, passed a comprehensive examination, and have a minimum of three years of relevant work experience.

CFP professionals are trained in various areas of financial planning, including investment planning, retirement planning, tax planning, estate planning, and risk management. Having the CFP designation ensures that the advisor you choose has a strong foundation in comprehensive financial planning and demonstrates their commitment to professionalism and ethical conduct.

Consider Chartered Financial Analyst (CFA) Credential

While not specifically focused on financial planning, the Chartered Financial Analyst (CFA) credential is another qualification worth considering. The CFA designation is globally recognized and demonstrates expertise in investment analysis and portfolio management.

Financial professionals who hold the CFA credential have a deep understanding of investment analysis, security valuation, economics, and ethics. While not all investment advisors or financial planners with the CFA designation may specialize in financial planning, this credential indicates a high level of knowledge and competence in the field of investments.

Evaluate Relevant Licenses and Registrations

In addition to credentials, it is crucial to evaluate the licenses and registrations held by your potential investment advisor or financial planner. Different financial professionals may hold licenses such as the Series 7 (General Securities Representative) or Series 65 (Uniform Investment Adviser Law Examination).

These licenses demonstrate that the advisor or planner has met specific regulatory requirements and has a comprehensive understanding of the securities industry. It is advisable to verify these licenses and registrations through the appropriate regulatory bodies to ensure the advisor is in good standing and compliant with industry regulations.

Evaluate Experience and Track Record

Assess Years of Industry Experience

Experience plays a vital role in choosing the right investment advisor or financial planner. Let’s face it – when it comes to managing your hard-earned money, you want someone who has been in the industry long enough to have a solid understanding of various financial situations and market conditions.

While years of industry experience alone don’t guarantee success, they often indicate the advisor’s ability to navigate through different market cycles and provide valuable insights. Consider looking for advisors with a track record of working with clients who have goals and needs similar to yours.

Inquire About Client Retention Rate

An advisor’s client retention rate can provide valuable insights into their ability to build and maintain long-term relationships with their clients. While it is common for advisors to have some client turnover due to life events or changing circumstances, a consistently high client retention rate generally indicates client satisfaction and trust in their services.

When considering an investment advisor or financial planner, don’t hesitate to inquire about their client retention rate. A high rate may suggest that the advisor puts their clients’ best interests first and provides a high level of customer service and personalized attention.

Review Track Record of Past Performance

While past performance is not indicative of future results, reviewing an advisor’s track record can provide valuable insights. Many advisors have experience managing investment portfolios and may have historical performance data available.

Reviewing their past performance can help you determine if their investment philosophy aligns with your goals and risk tolerance. Keep in mind that investments are subject to market fluctuations, and it is essential to have realistic expectations when evaluating an advisor’s track record.

This image is property of s3-us-east-2.amazonaws.com.

Consider the Advisor’s Specialization

Determine If the Advisor Specializes in Your Desired Investment Area

Depending on your specific financial needs, it may be beneficial to work with an investment advisor or financial planner who specializes in your desired investment area. For example, if you are primarily interested in socially responsible investing or sustainable investing, seek an advisor who has expertise in these areas.

Specialization ensures that your advisor understands the unique challenges, opportunities, and nuances of your investment area. They can guide you in making informed decisions that align with your values and financial goals.

Explore Advisors with Expertise in Tax Planning or Estate Planning

Tax planning and estate planning are two areas of financial planning that require specialized knowledge and expertise. If you have specific tax planning needs, seek an advisor who understands the complexities of tax laws and can help optimize your tax situation.

Similarly, if you require assistance with estate planning, finding an advisor who understands estate planning strategies can ensure that your assets are protected and distributed according to your wishes.

Check References and Client Reviews

Ask for References from Current or Previous Clients

Checking references is an excellent way to gather information about an investment advisor or financial planner’s reputation and service quality. Requesting references from current or previous clients allows you to speak directly with individuals who have worked with the advisor and can provide insights into their experience.

When contacting references, consider asking about the advisor’s communication style, responsiveness, expertise, and overall satisfaction with the services received. It can be helpful to ask for references from clients who have similar financial goals and needs as yours.

Seek Feedback from Online Platforms and Review Websites

In addition to speaking with references, take advantage of online platforms and review websites that provide feedback and ratings for investment advisors and financial planners. Websites like Yelp, BBB, and Investopedia may have reviews and ratings that offer valuable insights into an advisor’s reputation and service quality.

While online reviews should be taken with a grain of salt, they can provide a general sense of how past clients have perceived the advisor’s services. Look for patterns in the feedback and consider the overall sentiment before making a decision.

This image is property of www.bankrate.com.

Assess the Advisor’s Fee Structure

Understand Different Fee Models (Hourly, Flat, Commission)

Before finalizing your decision, it is important to understand the advisor’s fee structure. Different advisors may charge fees in various ways, including hourly fees, flat fees, or commissions.

Hourly fees are typically charged for specific services rendered, such as creating a financial plan or reviewing investment options. Flat fees are predetermined amounts charged for comprehensive financial planning services, regardless of the time spent. Commissions, on the other hand, are usually a percentage of the assets under management or a fee for specific investment products.

Each fee structure has its pros and cons, and it is crucial to choose one that aligns with your preferences and budget. Consider how the fee structure will affect your overall investment returns and whether it provides value for the services rendered.

Compare Fee Structures to Ensure Competitive Pricing

While fees should not be the sole determining factor when choosing an investment advisor or financial planner, comparing fee structures can help ensure competitive pricing. It is essential to strike a balance between reasonable fees and the level of service and expertise provided.

When evaluating fee structures, consider the overall value proposition offered by the advisor. A slightly higher fee may be justified if it comes with a higher level of personal attention, customized financial planning, or better investment performance.

Consider Accessibility and Availability

Evaluate the Advisor’s Availability for Meetings and Communication

Accessibility and availability are important considerations when choosing an investment advisor or financial planner. Find out how accessible the advisor is for meetings and consultations. Do they have specific office hours, or are they available outside regular business hours?

Additionally, consider their responsiveness to emails and phone calls. Open lines of communication are crucial when discussing investment strategies, financial goals, and any changes in your circumstances that may require adjustments to your financial plan.

Determine If the Advisor Provides Online or Digital Services

In today’s digital age, technology plays an essential role in financial services. Determine if the advisor offers online or digital services that can enhance your experience and make it more convenient.

Online account access, client portals, and video conferencing capabilities are some of the digital services that may be offered by investment advisors or financial planners. These services can provide flexibility and convenience, particularly if you have a busy schedule or prefer to manage your finances remotely.

This image is property of www.morganstanley.com.

Discuss Investment Philosophy and Strategy

Understand the Advisor’s Approach to Risk and Investment

When selecting an investment advisor or financial planner, it is important to understand their investment philosophy and strategy. The investment philosophy refers to the set of beliefs and principles that guide the advisor’s approach to managing investments. Some advisors may be more conservative and focus on capital preservation, while others may have a growth-oriented approach.

It is crucial to ensure that the advisor’s investment philosophy aligns with your risk tolerance and long-term goals. Discuss their strategies for asset allocation, diversification, and risk management. An advisor who takes the time to educate you about their investment philosophy and strategy is likely to help you make informed decisions and build a portfolio that aligns with your objectives.

Ensure Alignment with Your Personal Investment Style

In addition to understanding the advisor’s investment philosophy, it is equally important to consider whether their approach aligns with your personal investment style. Some individuals prefer a hands-off approach, where the advisor has more control over the investment decisions. Others may prefer a collaborative approach, where they are involved in the decision-making process.

Discuss your preferences and expectations with potential advisors to ensure that there is a good fit. A successful advisor-client relationship is built on mutual trust and understanding of each other’s investment style.

Evaluate the Advisor’s Ethics and Code of Conduct

Review the Advisor’s Code of Ethics or Conduct Standards

Ethics and integrity are crucial qualities to consider when choosing an investment advisor or financial planner. Review the advisor’s code of ethics or conduct standards to ensure that they operate with transparency, honesty, and in the best interests of their clients.

Look for advisors who prioritize ethical behavior, confidentially handle client information, and avoid conflicts of interest. An advisor’s commitment to professionalism and adherence to ethical standards can provide peace of mind and build trust in the advisory relationship.

Check for Any Disciplinary Actions or Complaints

Before making a final decision, it is important to perform due diligence on the advisor’s disciplinary history. Regulatory bodies such as FINRA (Financial Industry Regulatory Authority) or the SEC (Securities and Exchange Commission) maintain databases that allow you to research any disciplinary actions or complaints against the advisor.

While one or two minor infractions may not be cause for immediate concern, a pattern of disciplinary actions or serious misconduct may be a red flag. Ensure that the advisor has a clean record and has not engaged in any activities that could potentially harm your financial interests.

Choosing the right investment advisor or financial planner is a significant decision that can have a profound impact on your financial future. By identifying your goals and needs, understanding different advisor types, researching credentials, evaluating experience and specialization, gathering references and reviews, assessing fees and availability, discussing investment philosophy, and considering ethics, you can make an informed choice that aligns with your financial objectives and values. Remember, finding the right advisor who fits well with your needs and preferences is an important step towards achieving financial success.