If you’ve ever wondered how you can determine the success of your investments, look no further. Evaluating the performance of your investments may seem like a daunting task, but it can actually be quite simple with the right tools and knowledge. By utilizing historical charts and clear explanations, you can gain a better understanding of how your investments are performing. Additionally, we can provide you with reference links to popular investment broker sites that can help you get started on your investment journey. Say goodbye to uncertainty and hello to a clearer understanding of your investment performance.

How Can You Evaluate the Performance of Your Investments?

Investing can be a complex and challenging endeavor, but with the right knowledge and strategies, you can navigate the investment landscape with confidence. One key aspect of successful investing is evaluating the performance of your investments. By regularly assessing how your investments are performing, you can make informed decisions and adjust your strategy accordingly. In this article, we will explore ten essential steps to help you evaluate the performance of your investments effectively.

This image is property of www.financestrategists.com.

1. Set Clear Investment Objectives

Before evaluating the performance of your investments, it is crucial to establish clear investment objectives. By defining specific goals, determining a time frame, and assessing your risk tolerance, you can align your investment strategy with your financial aspirations.

1.1 Define Specific Goals

What are your investment objectives? Are you investing for retirement, education, or a major purchase? Clearly define your goals to ensure that your investment decisions are aligned with your long-term financial plans.

1.2 Determine Time Frame

Consider the time horizon for achieving your investment goals. Short-term goals may require more conservative investments, while long-term goals may allow for greater risk-taking and potential higher returns.

1.3 Assess Risk Tolerance

Understanding your risk tolerance is essential in evaluating the performance of your investments. Are you comfortable with market volatility, or do you prefer more stable and predictable returns? Assessing your risk tolerance will help you choose appropriate investment options.

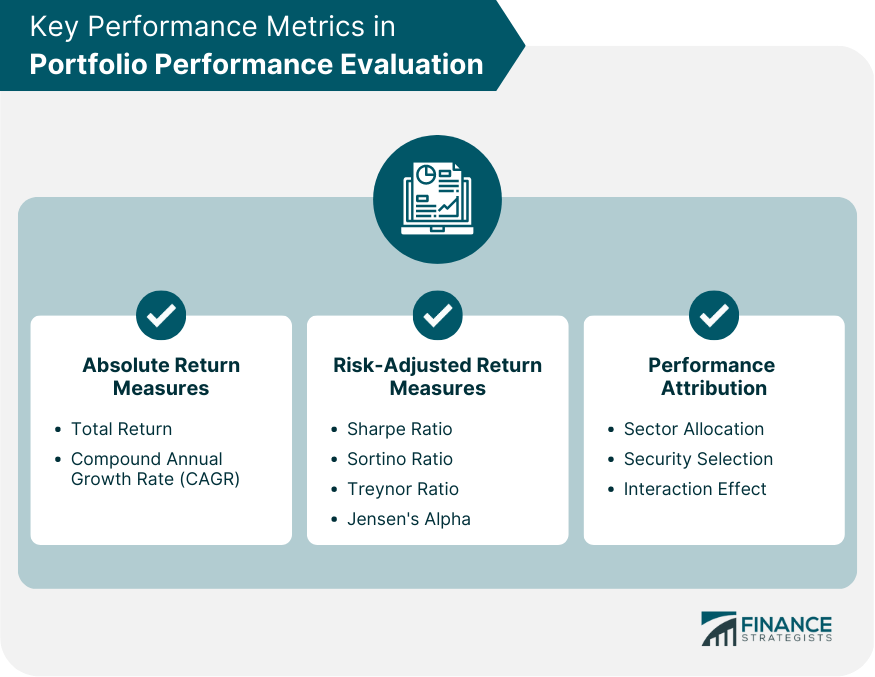

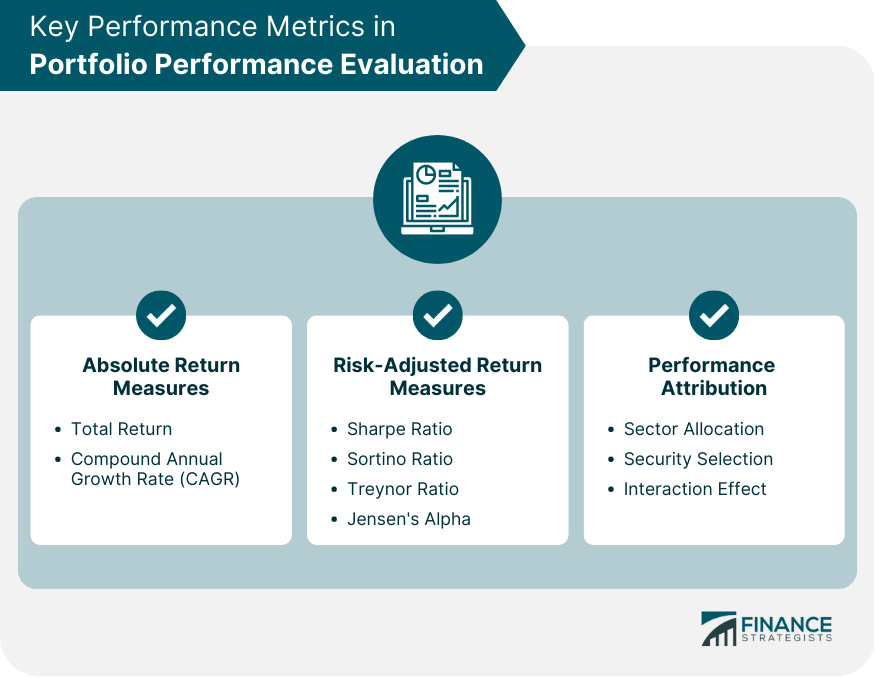

2. Understand Key Investment Metrics

To effectively evaluate the performance of your investments, it is essential to understand key investment metrics. These metrics provide crucial insights into the profitability, risk, and efficiency of your investment portfolio.

2.1 Return on Investment (ROI)

Return on Investment (ROI) measures the gain or loss generated on an investment relative to the amount invested. It is a valuable metric to assess the profitability of your investments and compare them with alternative investment opportunities.

2.2 Compound Annual Growth Rate (CAGR)

The Compound Annual Growth Rate (CAGR) measures the annualized rate of return for an investment over a specific period. It provides a more accurate representation of the investment’s performance, especially when evaluating long-term investments.

2.3 Risk-Adjusted Return

Risk-Adjusted Return measures the return an investment generates relative to the level of risk taken. It helps assess the efficiency of your investments by factoring in the associated risks.

2.4 Sharpe Ratio

The Sharpe Ratio measures the risk-adjusted return of an investment compared to a risk-free asset. It considers both risk and return, allowing you to evaluate whether the investment’s returns are commensurate with the level of risk taken.

2.5 Beta

Beta measures the sensitivity of an investment’s returns to changes in the overall market. It helps assess the investment’s volatility and its correlation to the broader market.

2.6 Price-to-Earnings Ratio (P/E Ratio)

The Price-to-Earnings Ratio (P/E Ratio) is a valuation metric used to evaluate the attractiveness of a stock. It compares the stock’s current price to its earnings per share, providing insights into its relative value.

2.7 Dividend Yield

Dividend Yield measures the annual dividend income generated by an investment relative to its price. It is particularly relevant for income-focused investors evaluating the performance of dividend-paying stocks or funds.

2.8 Expense Ratio

The Expense Ratio reflects the costs associated with owning a mutual fund or exchange-traded fund (ETF). It includes management fees, administrative expenses, and other operating costs. Evaluating the expense ratio can help assess the efficiency of your investment vehicle.

2.9 Turnover Ratio

Turnover Ratio measures the frequency with which securities within a mutual fund or ETF are bought and sold. It gives insights into the investment manager’s trading activity and can help evaluate the efficiency and potential tax implications of the fund.

2.10 Tracking Error

Tracking Error measures how closely an investment portfolio’s performance matches its benchmark index. It helps evaluate the effectiveness of an investment strategy and the skill of the investment manager in achieving desired returns.

This image is property of static.seekingalpha.com.

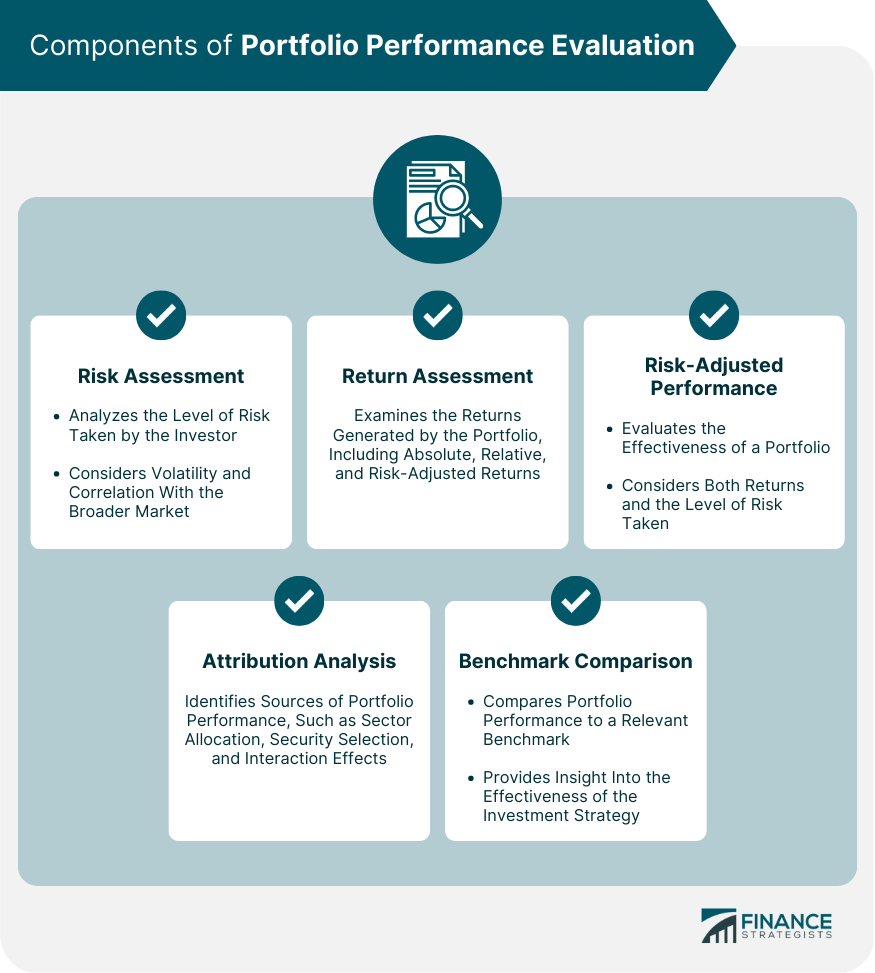

3. Monitor Investment Portfolio

To evaluate the performance of your investments effectively, it is essential to regularly monitor your investment portfolio. Monitoring allows you to stay informed about the progress of your investments and make timely adjustments when necessary.

3.1 Regularly Review Holdings

Reviewing your portfolio holdings on a regular basis helps you stay aware of any significant changes in your investments. Keeping track of individual stocks, mutual funds, or ETFs ensures that you are aware of any significant developments or events impacting their performance.

3.2 Track Changes in Asset Allocation

Asset allocation refers to the distribution of your investments among different asset classes, such as stocks, bonds, and cash equivalents. Tracking changes in your asset allocation allows you to maintain a balanced portfolio and make adjustments based on your investment objectives and risk tolerance.

3.3 Analyze Sector Allocation

In addition to asset allocation, analyzing sector allocation is crucial in evaluating your portfolio performance. Sector allocation refers to the distribution of your investments across different industry sectors. Understanding which sectors are performing well and which are underperforming can help you make informed decisions about sector-specific investments.

3.4 Assess Risk Exposure

Regularly assessing your portfolio’s risk exposure is essential in understanding the potential impact of market volatility on your investments. By evaluating the risk levels of individual holdings and the overall portfolio, you can manage risk effectively and take appropriate actions to mitigate potential losses.

3.5 Evaluate Investment Performance Against Benchmarks

Evaluating your investment’s performance against relevant benchmarks provides valuable insights into how your investments are performing relative to the broader market. It helps you determine whether your investments are outperforming or underperforming their respective benchmarks.

3.6 Consider the Impact of Taxes and Fees

When evaluating the performance of your investments, it is crucial to consider the impact of taxes and fees. High taxes and fees can significantly erode investment returns over time. Assessing the tax efficiency of your investments and minimizing unnecessary fees can help maximize your overall returns.

4. Calculate Investment Returns

Calculating investment returns is a fundamental step in evaluating the performance of your investments. By determining absolute returns, annualized returns, and adjusting for inflation, you can gain a comprehensive understanding of your investment performance.

4.1 Determine Investment Time Period

To calculate investment returns accurately, determine the time period for which you want to assess your returns. Whether it’s a specific year, quarter, or a longer duration, selecting the appropriate time period ensures meaningful analysis of your investments.

4.2 Calculate Absolute Returns

Absolute returns measure the total gain or loss on an investment over a specific period. It is calculated by subtracting the initial investment amount from the final investment value and expressing it as a percentage of the initial investment.

4.3 Calculate Annualized Returns

Annualized returns provide a standardized measure of investment performance, especially when evaluating investments held for different time periods. It calculates the average annual return over the investment duration, making it easier to compare investments with different holding periods.

4.4 Adjust Returns for Inflation

Inflation erodes the purchasing power of money over time, making it crucial to adjust investment returns for inflation. Adjusting for inflation provides a more accurate representation of the real return on your investments and its impact on your purchasing power.

This image is property of www.financestrategists.com.

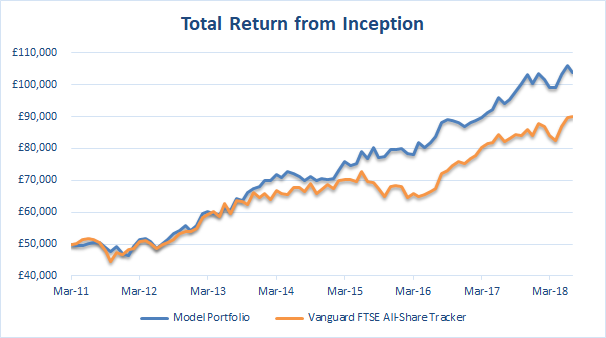

5. Compare Performance Against Benchmarks

Comparing your investment performance against relevant benchmarks helps you gauge the relative success of your investments. It provides insights into how your investments are performing compared to the broader market or specific indices.

5.1 Choose Appropriate Benchmarks

Selecting appropriate benchmarks is crucial in evaluating your investment performance. Benchmarks can be broad market indices, sector-specific indices, or specific investment styles, depending on the nature of your investments.

5.2 Evaluate Relative Performance

Comparing your investment performance against the benchmark’s performance allows you to assess whether your investments are outperforming or underperforming the market. Sustained outperformance or consistent underperformance may indicate the need for adjustments in your investment strategy.

5.3 Analyze Alpha and Beta Values

Alpha and beta are measures of an investment’s risk-adjusted performance relative to a benchmark. Alpha represents the excess return earned by an investment, while beta measures the investment’s sensitivity to market movements. Analyzing these values provides insights into your investment’s ability to generate positive returns and its level of market risk.

6. Evaluate Portfolio Risk

Evaluating portfolio risk is crucial to understanding the downside potential of your investments. By assessing standard deviation, downside deviation, Value at Risk (VaR), maximum drawdown, and correlation coefficients, you can gain insights into the risk exposure of your investment portfolio.

6.1 Assess Standard Deviation

Standard deviation measures the volatility of an investment’s returns. Evaluating standard deviation allows you to understand the level of risk associated with your investments and compare it to your risk tolerance.

6.2 Calculate Downside Deviation

Downside deviation measures the volatility of an investment’s negative returns. Unlike standard deviation, it focuses only on negative returns, providing a clearer picture of the investment’s downside risk.

6.3 Analyze Value at Risk (VaR)

Value at Risk (VaR) quantifies the maximum potential loss an investment portfolio may experience within a specific time frame and confidence level. Analyzing VaR helps you assess the downside risk of your investments and determine an acceptable level of loss.

6.4 Consider Maximum Drawdown

Maximum drawdown measures the largest peak-to-trough decline in the value of an investment or portfolio. Understanding the maximum drawdown allows you to assess the historical risk exposure of your investments and the potential impact of market downturns.

6.5 Evaluate Correlation Coefficients

Correlation coefficients measure the degree of association between different investments within your portfolio. Evaluating correlation coefficients helps you understand how individual investments move in relation to each other and assess the diversification benefits of your portfolio.

This image is property of www.finra.org.

7. Utilize Modern Portfolio Theory

Modern Portfolio Theory (MPT) provides a framework for optimizing investment portfolios by considering the relationship between risk and return. By understanding asset allocation, optimizing portfolio diversification, assessing risk-return trade-offs, and rebalancing periodically, you can align your investments with the principles of MPT.

7.1 Understand Asset Allocation

Asset allocation involves dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents. Understanding the principles of asset allocation helps you create a diversified portfolio that balances risk and return according to your investment goals.

7.2 Optimize Portfolio Diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and geographical regions. Optimizing portfolio diversification helps reduce the dependency on individual investments and minimizes the impact of market volatility on your portfolio.

7.3 Assess Portfolio Risk and Return Trade-offs

The risk and return trade-off is a fundamental concept in investing. Assessing the potential risk and return characteristics of your investments helps you make informed decisions regarding your portfolio’s composition and aligns with your risk tolerance and return objectives.

7.4 Rebalance Portfolio Periodically

Rebalancing your portfolio involves adjusting the asset allocation and investment weights to maintain the desired risk and return profile. Periodically rebalancing helps ensure that your portfolio remains aligned with your investment objectives and avoids excessive exposure to specific asset classes or investments.

8. Seek Professional Advice

Seeking professional advice is a wise move to supplement your own investment knowledge and experience. Financial advisors can provide personalized guidance and help you navigate complex investment decisions.

8.1 Consult Financial Advisors

Financial advisors are professionals who can help you develop an investment strategy tailored to your specific needs and goals. They can provide insights into investment opportunities, risk management, and overall financial planning.

8.2 Consider Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios. They offer cost-effective investment management solutions and can be a suitable option for investors who prefer a hands-off approach.

8.3 Explore Investment Courses or Books

Continuously expanding your investment knowledge is vital in evaluating the performance of your investments. Investing in educational resources, such as investment courses or books, can provide valuable insights and help you make more informed investment decisions.

This image is property of i.ytimg.com.

9. Consider Market Factors

Evaluating the performance of your investments requires staying informed about various market factors that can influence your investment returns. By evaluating economic indicators, staying updated on market news, analyzing industry trends, and monitoring geopolitical risks, you can make proactive investment decisions.

9.1 Evaluate Economic Indicators

Economic indicators, such as GDP growth rates, inflation rates, and interest rates, provide valuable insights into the overall health of the economy. Evaluating these indicators helps you better understand the macroeconomic environment and make informed investment decisions.

9.2 Stay Updated on Market News

Staying updated on market news allows you to stay informed about significant developments that can impact your investments. By monitoring market trends, company earnings reports, and regulatory changes, you can anticipate potential market moves and adjust your investment strategy accordingly.

9.3 Analyze Industry Trends

Analyzing industry trends helps you identify sectors that are poised for growth or facing challenges. By understanding sector-specific dynamics and trends, you can make informed investment decisions and capitalize on emerging opportunities.

9.4 Monitor Geopolitical Risks

Geopolitical risks, such as political instability, trade tensions, or regional conflicts, can significantly impact global financial markets. Monitoring geopolitical events allows you to assess potential risks and make timely adjustments to your investment portfolio.

10. Review and Adjust Investment Strategy

Regularly reviewing and adjusting your investment strategy is essential to stay on track with your investment goals. By reassessing your investment goals, adjusting asset allocation if needed, considering changing investment vehicles, and exiting underperforming investments, you can optimize your investment strategy.

10.1 Regularly Reassess Investment Goals

Life circumstances and financial goals can change over time. Regularly reassessing your investment goals ensures that your investment strategy remains aligned with your evolving needs and priorities.

10.2 Adjust Asset Allocation if Needed

As market conditions and your financial situation change, it may be necessary to adjust your portfolio’s asset allocation. Rebalancing your investments and realigning your asset allocation can help ensure that your investments remain in line with your desired risk and return profile.

10.3 Consider Changing Investment Vehicles

Evaluating the performance of your investments may reveal that certain investment vehicles are not delivering the desired results. In such cases, considering changing investment vehicles can be a prudent move to explore alternative investment options.

10.4 Exit Underperforming Investments

If an investment consistently underperforms or no longer aligns with your investment goals, it may be necessary to exit the position. Exiting underperforming investments frees up capital for potentially more lucrative investment opportunities.

10.5 Continuously Learn and Adapt

The investment landscape is dynamic and continually evolving. Continuously learning about new investment strategies, emerging asset classes, and market trends allows you to adapt your investment approach and take advantage of evolving opportunities.

In conclusion, evaluating the performance of your investments is a vital step in successful investing. By setting clear investment objectives, understanding key investment metrics, monitoring your investment portfolio, calculating investment returns, comparing performance against benchmarks, evaluating portfolio risk, utilizing Modern Portfolio Theory, seeking professional advice, considering market factors, and regularly reviewing and adjusting your investment strategy, you can make informed decisions and optimize your investment returns. Remember, investing is a journey, so continuously learn and adapt to navigate the ever-changing investment landscape with confidence.