Looking to expand your investment portfolio and unsure of where to start? Look no further! In this article, we will explore the concept of diversifying your investments, providing you with historical charts and clear explanations to help you understand the benefits. Additionally, we will provide reference links to popular investment broker sites, giving you a head start in your investment journey. So, if you’re wondering “how can I diversify my investment portfolio?” stick around as we guide you through the process with a friendly tone and expert knowledge.

This image is property of m.foolcdn.com.

Understanding the Importance of Diversification

Investing your hard-earned money is undoubtedly a big decision. You want to make sure that you are maximizing your returns while minimizing your risks. This is where portfolio diversification comes into play.

What is portfolio diversification?

Portfolio diversification is a strategy that involves spreading your investments across different types of assets with varying levels of risk and return. The idea behind diversification is simple – don’t put all your eggs in one basket. By diversifying your portfolio, you are not overly reliant on the performance of a single investment. Instead, you distribute your investments across different asset classes, industries, geographies, and investment styles. This helps reduce the impact of any single investment’s poor performance on your overall portfolio.

Why is diversification important?

Diversification is important because it helps you manage risk and potentially increase your chances of achieving your financial goals. By investing in a variety of assets, you are not exposed to the risk of a single asset class or investment. If one investment underperforms, the other investments can help offset the losses. Diversification also allows you to take advantage of different market conditions. When one asset class performs poorly, another might be doing well, leading to an overall more stable and consistent performance. By diversifying your portfolio, you are essentially reducing the potential impact of volatility and increasing the potential for consistent returns over the long term.

Types of Investments

When it comes to building a diversified portfolio, there are several types of investments you can consider. Let’s take a closer look at each of them:

Stocks

Stocks, also known as equities, represent ownership in a company. When you buy shares of stock, you essentially become a partial owner of that company. Stocks offer the potential for high returns, but they also come with higher risks. The value of stocks fluctuates based on several factors, including company performance, economic conditions, and market sentiment.

Bonds

Bonds are debt instruments through which investors lend money to governments, municipalities, or corporations in exchange for periodic interest payments and the return of the principal at maturity. Bonds are generally considered less risky than stocks and provide a fixed income stream. They can be an important component of a diversified portfolio, especially for investors seeking income and stability.

Mutual Funds

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification, liquidity, and professional management, making them an attractive investment option for beginners or individuals who prefer a hands-off approach.

Exchange-Traded Funds (ETFs)

Similar to mutual funds, ETFs also pool money from multiple investors and invest in a diversified portfolio of assets. However, unlike mutual funds, ETFs trade on stock exchanges like individual stocks. ETFs offer the benefits of diversification, flexibility, and low expenses. They are a popular investment choice for those looking to gain exposure to specific sectors, asset classes, or international markets.

Real Estate

Real estate investments involve buying, owning, or leasing properties, such as residential homes, commercial buildings, or land. Investing in real estate can provide income through rental payments and potential appreciation in property value. Real estate is known for its potential to diversify a portfolio and act as a hedge against inflation. However, it’s important to carefully consider factors such as location, market conditions, and maintenance costs before investing in real estate.

Commodities

Commodities are raw materials or primary agricultural products that are traded on exchanges. Examples of commodities include oil, gold, silver, wheat, and coffee. Investing in commodities can be a way to diversify a portfolio and potentially benefit from price movements in these markets. However, commodity prices can be volatile, and investing in commodities requires careful research and understanding of market dynamics.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual currencies that use cryptography for security. Cryptocurrencies have gained significant attention and popularity in recent years, offering potential high returns but also high volatility and risks. Investing in cryptocurrencies can be a way to diversify a portfolio, but it is important to thoroughly research and understand the unique characteristics and risks associated with these digital assets.

Alternative Investments

Alternative investments encompass a wide range of non-traditional investment assets, such as hedge funds, private equity, venture capital, and artwork. These investments often have lower correlations with traditional asset classes and can provide additional diversification benefits. However, alternative investments are generally more complex and illiquid, requiring a higher level of due diligence and expertise.

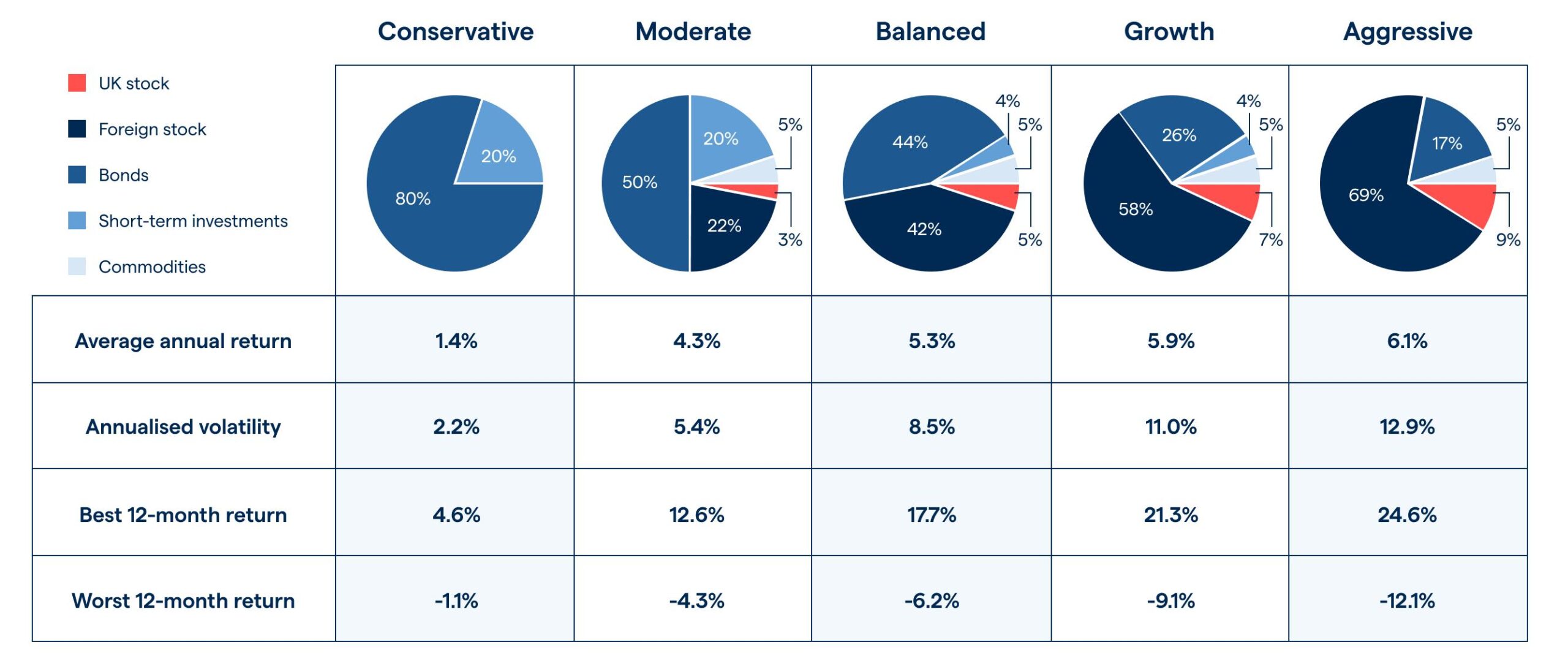

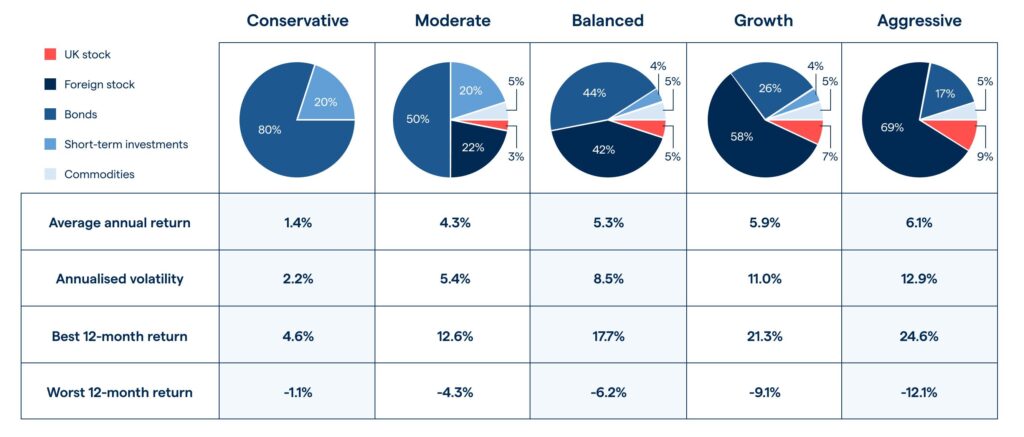

This image is property of www.fidelity.com.

Assessing Risk and Return

Before diversifying your portfolio, it’s crucial to consider your risk tolerance, investment goals, and investment horizon.

Risk tolerance and investment goals

Your risk tolerance refers to how comfortable you are with the possibility of losing money. Some investors are willing to take higher risks for the potential of higher returns, while others prefer a more conservative approach. Understanding your risk tolerance and investment goals is essential in determining the appropriate mix of investments for your portfolio.

Determining your investment horizon

Your investment horizon is the length of time you expect to hold your investments before needing the funds. It can vary depending on your financial goals, such as retirement, purchasing a home, or funding your child’s education. The longer your investment horizon, the more risk you may be able to tolerate and potentially benefit from the compounding growth of your investments.

Understanding risk and reward

Every investment carries some level of risk. It’s important to understand the risks associated with each investment option and assess whether the potential rewards outweigh those risks. Generally, investments with higher potential returns tend to have higher associated risks. Balancing risk and reward is critical in building a diversified portfolio that aligns with your goals and risk tolerance.

Measuring investment risk

Investment risk can be assessed through various metrics, such as volatility, standard deviation, beta, and Sharpe ratio. These measures help investors understand the historical performance and volatility of an investment, enabling them to make more informed decisions. It’s important to consider the risk characteristics of the investments you include in your portfolio and ensure they align with your risk tolerance and investment objectives.

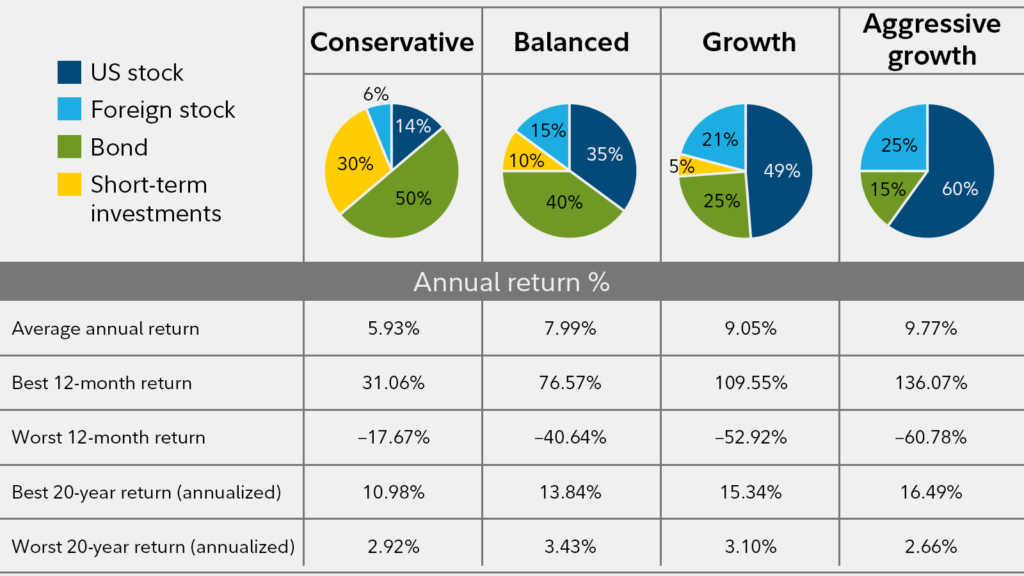

Determining the optimal asset allocation

Asset allocation refers to the distribution of your portfolio across different asset classes, such as stocks, bonds, and cash. The optimal asset allocation depends on factors such as your risk tolerance, investment goals, time horizon, and market conditions. A balanced asset allocation can help manage risk and maximize returns by taking advantage of different asset classes’ performance characteristics.

Developing a Diversification Strategy

Once you have assessed your risk tolerance, investment goals, and time horizon, it’s time to develop a diversification strategy for your portfolio.

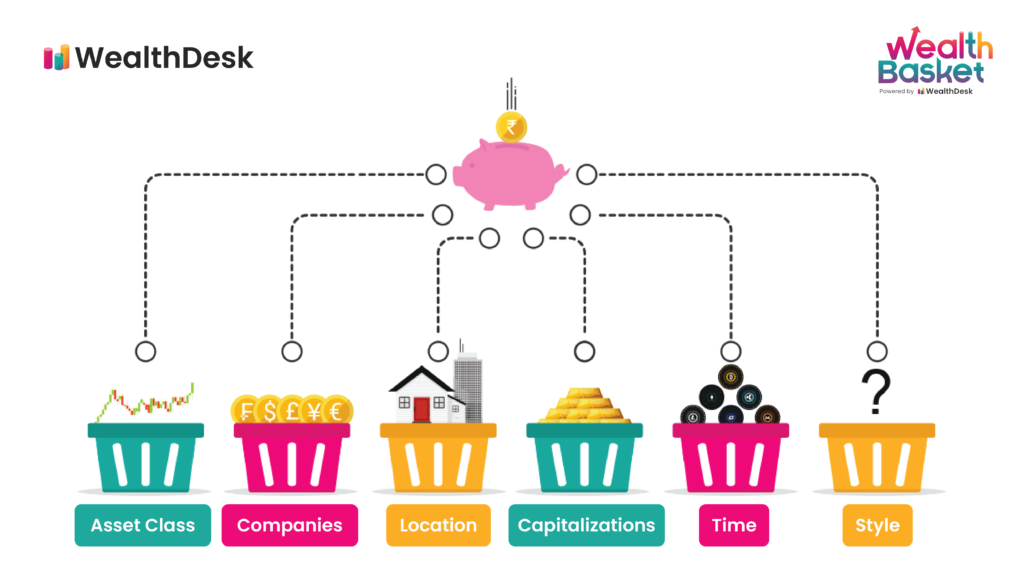

Asset allocation

One of the key elements of diversification is determining the appropriate asset allocation for your portfolio. This involves deciding how much of your portfolio should be allocated to different asset classes, such as stocks, bonds, and cash. The optimal asset allocation depends on your risk tolerance, investment goals, and time horizon. Generally, a diversified portfolio includes a mix of asset classes that can provide a balance between potential growth and stability.

Geographical diversification

Geographical diversification involves spreading your investments across different countries and regions. Investing solely in your home country exposes you to country-specific risks. By diversifying internationally, you can benefit from global economic growth and potentially reduce the impact of any single country’s economic downturn on your portfolio. Geographic diversification can be achieved through investments in international stocks, bonds, or mutual funds with global exposure.

Industry diversification

Industry diversification involves investing in companies operating in different sectors of the economy. Each industry has its own set of opportunities and risks. By diversifying across various industries, you can reduce the impact of poor performance in a specific sector on your portfolio. For example, if one sector, such as technology, is experiencing a downturn, investments in other sectors, such as healthcare or consumer staples, may help offset the losses.

Capitalization diversification

Capitalization diversification refers to investing in companies of different sizes, such as large-cap, mid-cap, and small-cap stocks. Large-cap stocks tend to be more stable and established, while small-cap stocks have higher growth potential but also higher volatility. By diversifying across different market capitalizations, you can balance risk and potential returns, taking advantage of the unique characteristics of each category.

Sector diversification

Sector diversification involves investing in companies within a specific sector or industry. Each sector has its own risk and return characteristics. By diversifying across sectors, you can reduce the impact of poor performance in a particular sector on your overall portfolio. For example, if the healthcare sector is performing poorly, investments in other sectors, such as technology or consumer discretionary, may help mitigate the losses.

Diversification based on investment style

Diversification based on investment style involves including a mix of growth-oriented and value-oriented investments in your portfolio. Growth-oriented investments focus on companies with high growth potential, while value-oriented investments focus on undervalued companies with the potential for future price appreciation. By diversifying across different investment styles, you can potentially benefit from different market cycles and investment approaches.

This image is property of wealthdesk.in.

Building a Balanced Portfolio

Building a balanced portfolio requires careful consideration of various factors and aligning your investments with your financial goals and risk tolerance.

Consider the time frame for your investments

One of the first steps in building a balanced portfolio is to consider the time frame for your investments. Short-term goals, such as saving for a vacation or down payment on a house, may require a more conservative approach with a greater emphasis on capital preservation. Long-term goals, such as retirement, provide more flexibility to take on higher-risk investments that have the potential for higher returns.

Establish clear investment objectives

Establishing clear investment objectives is crucial in building a balanced portfolio. Are you looking for income, capital growth, or a combination of both? Are you investing for the long term or short term? Clearly defining your investment objectives will help guide your asset allocation decisions and the selection of appropriate investments.

Determining your risk appetite

Understanding your risk appetite is an essential aspect of building a balanced portfolio. It is important to be realistic about how much risk you are willing to take on. While higher-risk investments may offer the potential for higher returns, they also come with a greater potential for losses. Balancing risk and potential rewards is crucial in creating a portfolio that aligns with your risk tolerance and financial goals.

Choosing the right mix of investments

Choosing the right mix of investments is key to building a balanced portfolio. This involves diversifying across different asset classes, such as stocks, bonds, and cash, as well as across different sectors, geographies, and investment styles. The mix of investments should reflect your risk tolerance, investment goals, and time horizon. Regular review and rebalancing of your portfolio can help ensure that your investments remain aligned with your desired asset allocation.

Setting realistic expectations

Setting realistic expectations is important in building a balanced portfolio. It’s essential to understand that investment returns can vary over time, and there may be periods of market volatility or underperformance. It’s important to have a long-term perspective and not get swayed by short-term market movements. By setting realistic expectations and staying focused on your investment objectives, you are more likely to make informed decisions and stick to your investment strategy.

Investing in Mutual Funds and ETFs

Mutual funds and ETFs are popular investment vehicles that can provide diversification benefits and ease of access to various asset classes.

Understanding mutual funds and ETFs

Mutual funds and ETFs are investment vehicles that pool money from multiple investors and invest in a diversified portfolio of assets. Both offer investors the ability to own a diversified portfolio without having to purchase individual stocks or bonds. Mutual funds are typically managed by professional fund managers, whereas ETFs are traded on stock exchanges and can be bought and sold throughout the trading day, like individual stocks.

Advantages of investing in mutual funds and ETFs

Investing in mutual funds and ETFs offers several advantages. Firstly, they provide instant diversification by holding a portfolio of stocks, bonds, or other assets. This diversification helps reduce the risk associated with owning individual securities. Secondly, mutual funds and ETFs are managed by professional fund managers who have expertise in selecting and managing investments. This can be beneficial for investors who prefer a hands-off approach or lack the time and expertise to research individual investments.

Types of mutual funds and ETFs

There are various types of mutual funds and ETFs available, catering to different investment objectives and risk profiles. Some common types include equity funds, bond funds, index funds, sector funds, and international funds. Equity funds focus on investing in stocks, while bond funds invest in fixed-income securities. Index funds aim to replicate the performance of a specific market index, while sector funds concentrate on specific sectors or industries. International funds provide exposure to global markets outside your home country.

Analyzing fund performance and expenses

When considering investing in mutual funds or ETFs, it’s important to analyze fund performance and understand the associated expenses. Performance can be evaluated through metrics such as annualized return, volatility, and risk-adjusted returns. Moreover, it’s crucial to consider the expense ratio and any additional fees associated with the fund. Lower expense ratios generally indicate lower costs for investors, boosting overall returns.

Selecting the right mutual fund or ETF

Selecting the right mutual fund or ETF involves considering various factors. Start by identifying your investment goals, risk tolerance, and time horizon. Look for funds that align with these factors and have a consistent track record of delivering returns. Also, consider the fund’s investment strategy, management style, expense ratio, and historical performance relative to its benchmark. By conducting thorough research and seeking professional advice if needed, you can make informed decisions and select the right mutual fund or ETF for your portfolio.

This image is property of a.c-dn.net.

Exploring Alternative Investments

Alternative investments offer unique diversification opportunities beyond traditional asset classes. Let’s explore what they are and how they can enhance your portfolio.

What are alternative investments?

Alternative investments are non-traditional investment assets that typically fall outside the scope of stocks, bonds, and cash. They can include a wide range of investments, such as hedge funds, private equity, venture capital, real estate, commodities, art, and collectibles. These investments often have lower correlations with traditional asset classes, making them attractive for diversification purposes.

Types of alternative investments

There are various types of alternative investments, each with its own characteristics and risk profiles. Hedge funds are professionally managed investment funds that aim to generate positive returns regardless of market conditions. Private equity involves investing in privately-held companies or assets not traded on public exchanges. Venture capital focuses on funding early-stage companies with high growth potential. Real estate, commodities, art, and collectibles offer tangible asset classes that can provide diversification benefits and potential appreciation.

Benefits and risks of alternative investments

Alternative investments offer several benefits that traditional asset classes may not provide. They can enhance diversification by reducing portfolio risk through exposure to different investment strategies and market segments. Alternative investments can also provide potential returns that are less influenced by traditional market factors. However, alternative investments can be complex, illiquid, and require a higher level of expertise and due diligence. They may also carry higher fees and minimum investment requirements.

Considerations when investing in alternatives

Investing in alternative investments requires careful consideration of various factors. First, you need to assess your risk tolerance and investment objectives. Alternative investments may have different risk-return profiles compared to traditional asset classes, and you must be comfortable with the associated risks. Additionally, due to their unique characteristics, alternative investments may have longer lock-up periods and limited liquidity. It’s important to evaluate the investment’s structure, performance history, fees, and the expertise of the investment manager.

Diversifying with alternative investments

Including alternative investments in your portfolio can enhance diversification and potentially improve the risk-reward profile. They have the ability to provide returns that are not closely tied to traditional market conditions. By having exposure to different asset classes, strategies, and market segments, you can reduce portfolio volatility and potentially increase overall returns. When considering alternative investments, it’s important to ensure they align with your investment goals and risk tolerance, and to diversify within the alternative asset class itself.

Monitoring and Rebalancing Your Portfolio

Building a diversified portfolio is not a one-time task; it requires regular monitoring and potential rebalancing to maintain its intended allocation.

Importance of regular portfolio monitoring

Regular portfolio monitoring plays a crucial role in ensuring that your investments are aligned with your investment goals and risk tolerance. Monitoring allows you to stay informed about the performance of your investments and make necessary adjustments as needed. By staying actively involved, you can seize opportunities and address any underperforming investments in a timely manner.

Reviewing and adjusting asset allocation

As market conditions change and your financial goals evolve, it’s important to review and adjust your asset allocation periodically. Asset allocation that was suitable in the past may no longer be appropriate in the current market environment. Regularly reviewing your portfolio’s performance and evaluating your investment goals can help determine whether adjustments to your asset allocation are necessary.

Rebalancing strategies

Rebalancing involves adjusting your portfolio’s asset allocation back to its original target. Over time, certain investments may outperform or underperform, causing your portfolio to deviate from its desired allocation. Rebalancing allows you to restore the intended balance and ensure that your portfolio aligns with your risk tolerance and investment goals. Rebalancing can be done either on a predetermined schedule or when certain asset classes deviate significantly from their target weights.

Key indicators for portfolio review

When reviewing your portfolio, it’s important to consider key indicators such as investment performance, asset allocation, and risk exposure. Look at how the individual investments in your portfolio have performed and whether they are aligning with your expectations. Assess the overall asset allocation and make sure it still matches your desired risk profile. Also, evaluate your portfolio’s risk exposure to ensure it is adequately diversified and not overly concentrated in a particular investment, sector, or geography.

Seeking professional advice

Managing a diversified portfolio can be complex, especially if you are unfamiliar with the intricacies of investment analysis and portfolio management. Seeking professional advice from a financial advisor can help simplify the process and provide valuable insights. A financial advisor can help you establish a suitable asset allocation, monitor your portfolio, and make adjustments as needed based on your individual circumstances and investment goals.

This image is property of www.wallstreetmojo.com.

Managing Taxes and Fees

Managing taxes and minimizing investment fees and expenses are crucial aspects of portfolio management. Let’s explore some strategies to maximize your investment returns.

Understanding tax implications

Investments can have various tax implications, including capital gains taxes and income taxes. It’s important to understand the tax consequences before making investment decisions. For example, long-term capital gains are generally taxed at a lower rate than short-term capital gains. Similarly, dividend income may be subject to different tax rates depending on the type of dividend and your tax bracket. By considering tax implications, you can make more informed investment decisions and potentially reduce your tax liability.

Tax-efficient investing strategies

Tax-efficient investing strategies aim to minimize the tax impact on your investment returns. Some strategies include maximizing contributions to tax-advantaged accounts, such as individual retirement accounts (IRAs), 401(k) plans, or health savings accounts (HSAs), which offer tax advantages such as tax-deferred growth or tax-free withdrawals. Additionally, tax-loss harvesting involves selling investments that have declined in value to offset capital gains and potentially reduce your taxable income. By employing tax-efficient strategies, you can optimize your after-tax investment returns.

Minimizing investment fees and expenses

Investment fees and expenses can eat into your overall investment returns over time. It’s important to understand the fees associated with your investments, such as management fees, expense ratios, loads (sales charges), and transaction costs. Look for investment options with competitive fees and consider lower-cost alternatives, such as index funds or ETFs, which tend to have lower expense ratios compared to actively managed funds. Minimizing investment fees and expenses can help maximize your long-term investment returns.

Considering tax-advantaged accounts

Tax-advantaged accounts, such as IRAs, 401(k)s, and HSAs, offer potential tax benefits that can enhance your investment returns. Contributions to these accounts may be tax-deductible, and earnings grow tax-deferred or tax-free, depending on the account type. Withdrawals from certain tax-advantaged accounts may also be tax-free or subject to lower tax rates under specific conditions. By taking advantage of these accounts, you can potentially reduce your current tax liability and accumulate more for your future financial goals.

Risks and Pitfalls of Portfolio Diversification

While portfolio diversification offers numerous benefits, there are also risks and pitfalls to be aware of.

Over-diversification

Over-diversification occurs when a portfolio becomes so heavily diversified that it starts to resemble an index fund. While diversification is important, over-diversification can reduce the potential for outsized returns. By spreading your investments too thin, you may dilute the impact of your best-performing investments, making it more challenging to achieve higher returns. It’s important to strike the right balance between diversification and concentration to optimize your portfolio’s risk-reward profile.

Lack of diversification

On the other end of the spectrum, a lack of diversification can expose your portfolio to greater risk. Concentrating your investments in a single asset class, industry, or geographic region can amplify the impact of any adverse events or downturns. A lack of diversification can leave your portfolio vulnerable to specific risks and reduce its ability to withstand market volatility. It’s important to ensure that your portfolio is adequately diversified to manage risk and potentially enhance returns.

Investment fraud and scams

Diversifying your portfolio does not guarantee protection against investment fraud and scams. It’s essential to be vigilant and conduct thorough research before investing in any product or opportunity. Beware of promises of high returns with little or no risk. Always verify the legitimacy of the investment, check the credentials of the individuals or firms involved, and be cautious of unsolicited investment offers. If something seems too good to be true, it probably is.

Market volatility and economic conditions

Even with a well-diversified portfolio, it’s important to recognize that investment values can fluctuate due to market volatility and changes in economic conditions. Market downturns and economic recessions can impact investments across different asset classes and sectors. It’s important to maintain a long-term perspective, stay informed about market trends, and make informed decisions based on your investment goals and risk tolerance.

Psychological biases and emotions

Psychological biases and emotions can pose challenges when managing a diversified portfolio. Investors are often influenced by fear, greed, and herd mentality, which can lead to irrational investment decisions. For example, during a market downturn, the fear of further losses may lead some investors to sell their investments at the wrong time, missing out on potential recoveries. It’s important to stay disciplined, avoid making impulsive decisions based on short-term market fluctuations, and focus on your long-term investment strategy.

In summary, understanding the importance of diversification is essential for building a resilient and well-balanced investment portfolio. By diversifying across different asset classes, industries, geographies, and investment styles, you can manage risk, potentially enhance returns, and increase the likelihood of achieving your financial goals. Developing a diversification strategy, regularly monitoring and rebalancing your portfolio, managing taxes and expenses, and being aware of the risks and pitfalls will help you navigate the complex world of investing and build a portfolio that aligns with your unique circumstances and objectives. Remember, diversification is not a one-time event but an ongoing process that requires attention and adjustments as your financial situation evolves. Seek professional advice if needed and stay informed to make the most of your investment journey.