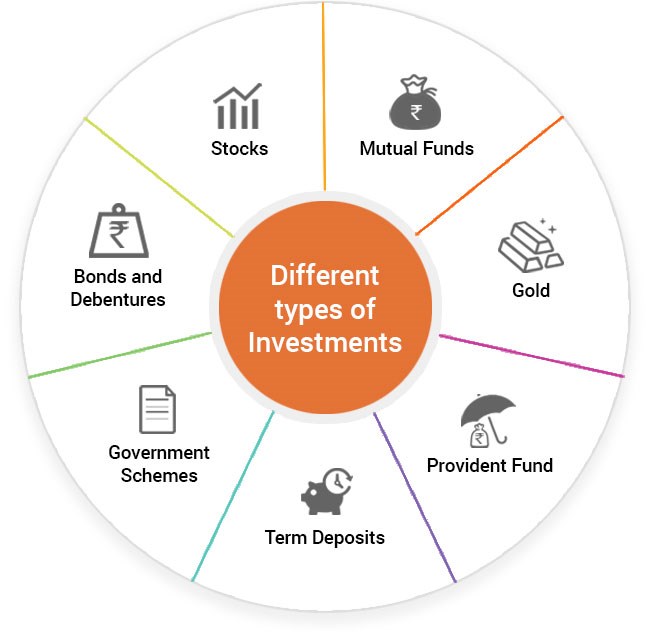

Are you ready to take charge of your financial future? It’s time to explore the world of investments and discover the various options available to you. In this article, we will discuss the different types of investments that can help you grow your money and achieve your financial goals. From stocks and bonds to real estate and mutual funds, we will provide you with clear explanations and historical charts to help you understand the potential returns and risks associated with each investment. Whether you’re a seasoned investor or just starting out, we will also provide reference links to popular investment broker sites, making it easy for you to get started on your investment journey. So, let’s dive in and explore the exciting world of investments together!

This image is property of www.creditrepair.com.

Stocks

Common Stocks

Common stocks are the most well-known and commonly traded type of stock. When you buy common stock, you become a partial owner of the company. As a shareholder, you have certain rights such as voting on company policies and electing board members. Common stockholders also have the potential to receive dividends, which are a portion of the company’s profits distributed to shareholders. However, common stockholders are last in line to receive dividends and in the event of bankruptcy, they have the lowest priority in recovering their investment.

Preferred Stocks

Preferred stocks are a distinct class of stocks that offer certain advantages over common stocks. With preferred stocks, shareholders have a higher claim to the company’s assets and earnings than common shareholders. This means that if the company goes bankrupt, preferred stockholders have a higher chance of recovering their investment. In addition, preferred stockholders often receive fixed dividends, which are paid out before any dividends are given to common stockholders. However, unlike common stockholders, preferred stockholders usually do not have voting rights in the company.

Blue-Chip Stocks

Blue-chip stocks refer to shares of well-established, financially stable companies that have a history of consistent growth and reliable dividends. These companies are often leaders in their respective industries and are known for their strong balance sheets and stable cash flows. Blue-chip stocks are considered relatively safe investments and are often favored by long-term investors who are looking for steady returns. Examples of blue-chip stocks include companies like Coca-Cola, Johnson & Johnson, and Microsoft.

Growth Stocks

Growth stocks are shares of companies that are expected to grow at an above-average rate compared to the overall market. These companies often reinvest their earnings back into the business to fund expansion projects and acquire new customers. Growth stocks are known for their potential to generate capital gains, but they typically do not pay significant dividends. Investing in growth stocks can be risky since the future growth outlook is uncertain, and there is the possibility of the stock price falling if the company fails to meet expectations.

Value Stocks

Value stocks are shares of companies that are considered undervalued by the market. These stocks are often characterized by a low price-to-earnings (P/E) ratio or other metrics that indicate they are trading at a discount compared to their intrinsic value. Value stocks are popular among investors who believe that the market has overlooked their true worth and expect the stock price to rise as the market realizes their value. Investors in value stocks often focus on finding companies with solid fundamentals and a strong track record.

Dividend Stocks

Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends. These stocks are popular among income-oriented investors who are looking for a steady stream of cash flow from their investments. Dividend stocks tend to be more stable and less volatile than other types of stocks. They often belong to mature companies that have steady cash flows and a long history of paying dividends. Dividend stocks can provide a reliable source of income for investors, especially those who are in or nearing retirement.

Bonds

Government Bonds

Government bonds, also known as treasury bonds, are debt securities issued by a government to finance its spending. When you buy a government bond, you are essentially lending money to the government in exchange for periodic interest payments, usually semiannually or annually, and the return of the principal amount at maturity. Government bonds are considered one of the safest investments since they are backed by the full faith and credit of the government. The risk of default is generally low, especially for bonds issued by stable governments.

Corporate Bonds

Corporate bonds are debt securities issued by corporations to raise capital. Unlike government bonds, corporate bonds carry a higher level of risk since they depend on the creditworthiness of the issuing company. The interest rates on corporate bonds are generally higher to compensate investors for the additional risk. Corporate bonds come in various forms, including investment-grade bonds issued by highly-rated companies and high-yield or junk bonds issued by lower-rated or financially troubled firms.

Municipal Bonds

Municipal bonds, also known as munis, are debt securities issued by state and local governments or government agencies. Municipal bonds are used to finance public infrastructure projects such as schools, roads, and hospitals. One of the main attractions of municipal bonds is their tax-exempt status, meaning the interest earned on them is generally not subject to federal income tax. In some cases, the interest may also be exempt from state and local income taxes, depending on the bond issuer and the investor’s place of residence.

Treasury Bonds

Treasury bonds, also known as T-bonds, are long-term government bonds issued by the U.S. Department of the Treasury. These bonds have a maturity period of more than 10 years and pay interest to investors every six months until maturity. Treasury bonds are considered one of the safest investments, as they are backed by the full faith and credit of the U.S. government. They are an attractive option for investors seeking capital preservation and a reliable income stream over an extended period.

This image is property of blog.mint.com.

Mutual Funds

Equity Funds

Equity funds, also known as stock funds, are mutual funds that primarily invest in stocks. These funds pool money from multiple investors and use it to purchase a diversified portfolio of stocks. Equity funds can focus on different investment styles, such as growth, value, or a combination of both. By investing in an equity fund, you gain exposure to a broad range of stocks and benefit from the expertise of professional fund managers. Equity funds offer the potential for capital appreciation and are suitable for investors with a longer time horizon.

Fixed-Income Funds

Fixed-income funds, also known as bond funds, are mutual funds that primarily invest in fixed-income securities such as government bonds, corporate bonds, and municipal bonds. These funds provide investors with a steady stream of income through regular interest payments. Fixed-income funds vary in terms of risk and return, depending on the specific types of bonds held in the portfolio. They are suitable for investors who prioritize income generation and want to reduce the potential volatility associated with equity investments.

Index Funds

Index funds are a specific type of mutual fund that aims to replicate the performance of a specific market index, such as the S&P 500. Rather than actively selecting stocks or bonds, index funds passively invest in all or a representative sample of the securities in the target index. These funds offer diversification, low costs, and simplicity since they aim to match the performance of the index rather than outperform it. Index funds are popular among investors who believe in the efficiency of the market and want to achieve broad market exposure.

Bond Funds

Bond funds are mutual funds that primarily invest in various types of bonds, such as government bonds, corporate bonds, and municipal bonds. These funds provide investors with exposure to the fixed-income market and the potential for regular income. Bond funds can have different durations and risk levels, depending on the types of bonds held in the portfolio. They are suitable for investors who want to maintain a balanced investment portfolio and generate income without having to invest in individual bonds.

Money Market Funds

Money market funds are mutual funds that invest in short-term, low-risk fixed-income securities, such as Treasury bills and certificates of deposit. These funds aim to preserve capital while providing liquidity and a modest level of return. Money market funds are considered a safe and convenient place to park cash temporarily, such as the proceeds from a sale or as a place to hold emergency funds. They typically offer higher interest rates than traditional savings accounts and are suitable for investors looking for a low-risk investment with easy access to their money.

Exchange-Traded Funds (ETFs)

Index ETFs

Index ETFs are exchange-traded funds that track the performance of a specific market index. Similar to index funds, index ETFs aim to replicate the returns of the target index by holding a diversified portfolio of securities. However, unlike mutual funds, ETFs trade on stock exchanges like individual stocks throughout the trading day. Index ETFs offer the advantages of diversification, low costs, and flexibility, making them popular among both long-term investors and active traders.

Sector ETFs

Sector ETFs are exchange-traded funds that focus on specific sectors or industries of the economy, such as technology, healthcare, or energy. These ETFs provide investors with a convenient way to gain exposure to a particular sector without having to buy individual stocks. Sector ETFs allow investors to capitalize on the growth prospects of specific industries or hedge against potential downturns in particular sectors. They are suitable for investors who want to tailor their investment portfolios to specific sectors or take advantage of short-term sector trends.

Commodity ETFs

Commodity ETFs are exchange-traded funds that invest in commodities such as gold, oil, or agricultural products. These ETFs can provide investors with exposure to the price movements of physical commodities without the need to own the underlying assets directly. Commodity ETFs can be a way to diversify an investment portfolio and hedge against inflation or other economic factors that may affect commodity prices. They are popular among investors seeking alternative investment opportunities and diversification outside of traditional stocks and bonds.

Bond ETFs

Bond ETFs are exchange-traded funds that invest in fixed-income securities such as government bonds, corporate bonds, and municipal bonds. These ETFs offer investors the convenience and flexibility of trading bonds on stock exchanges. Bond ETFs provide exposure to a diversified portfolio of bonds with different maturities and risk levels. They can be used to generate income and manage interest rate risk in a portfolio. Bond ETFs are suitable for investors who want to invest in bonds but prefer the liquidity and transparency of ETFs over individual bonds.

This image is property of assets.site-static.com.

Real Estate

Residential Properties

Residential properties are real estate assets that are used as homes or dwellings. Investing in residential properties involves purchasing properties with the intention of renting them out or selling them for a profit. Residential properties can provide both rental income and potential appreciation in value over time. The residential real estate market can offer opportunities for investors looking to generate stable cash flow and build long-term wealth through property ownership.

Commercial Properties

Commercial properties refer to real estate assets that are used for business purposes, such as office buildings, retail spaces, hotels, and industrial properties. Investing in commercial properties can provide rental income from businesses that lease the space. Commercial properties may offer higher rental yields compared to residential properties, but they also come with greater risks and complexities. Commercial real estate can be a lucrative investment for experienced investors who have the knowledge and resources to manage and lease commercial properties.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, or REITs, are companies that own, operate, or finance income-generating real estate properties. REITs allow investors to invest in real estate without the need to purchase and manage physical properties directly. By investing in REITs, investors can gain exposure to a diversified portfolio of properties and earn income through rental revenues. REITs are required to distribute a significant portion of their income as dividends to shareholders, making them attractive for income-oriented investors.

Certificates of Deposit (CDs)

Traditional CDs

Traditional CDs, also known as time deposits, are a type of deposit offered by banks and credit unions. When you invest in a CD, you agree to keep your money in the bank for a fixed period, known as the term or maturity period. In return for locking in your funds, the bank pays you a fixed interest rate that is typically higher than that of a regular savings account. Traditional CDs are considered low-risk investments since they are insured by the FDIC (for banks) or NCUA (for credit unions) up to certain limits.

Liquid CDs

Liquid CDs are a variation of traditional CDs that offer some flexibility in terms of accessing your funds before the maturity date. With a liquid CD, you can withdraw a portion of your principal without paying an early withdrawal penalty. However, the interest rate on liquid CDs is usually lower than that of traditional CDs, and there may be restrictions on how much can be withdrawn. Liquid CDs can be suitable for investors who want a low-risk investment with the potential for higher returns than a regular savings account and some access to their funds.

Callable CDs

Callable CDs are a type of certificate of deposit that allows the issuer, usually a bank, to redeem the CD before the maturity date. Callable CDs typically offer higher interest rates than traditional CDs to compensate for the risk of early redemption. If the issuer exercises the call option, you will receive the principal amount along with any accrued interest up to the call date. Callable CDs are suitable for investors who are willing to take on the risk of early redemption in exchange for potentially higher yields.

This image is property of www.edelweiss.in.

Options

Call Options

Call options are derivative contracts that give the holder the right, but not the obligation, to buy an underlying asset, such as stocks or commodities, at a predetermined price within a specified time frame. By purchasing a call option, you are betting that the price of the underlying asset will rise above the strike price before the option expires. Call options can be used for various purposes, including speculation, hedging, and income generation through option writing. However, options trading can be complex and risky, so it requires careful understanding and risk management.

Put Options

Put options are derivative contracts that give the holder the right, but not the obligation, to sell an underlying asset at a predetermined price within a specified time frame. By buying a put option, you are speculating that the price of the underlying asset will fall below the strike price before the option expires. Put options can be used for hedging against a decline in the value of existing investments or as a standalone speculative trade. As with call options, trading put options involves risks and requires knowledge of options strategies.

Commodities

Precious Metals

Precious metals, such as gold, silver, platinum, and palladium, are widely recognized as store of value assets. Investing in precious metals can offer diversification and a hedge against inflation or economic uncertainties. Precious metals can be purchased in physical form, such as bars and coins, or through investment vehicles such as exchange-traded funds (ETFs) and mutual funds that track the price movements of these metals. Investing in precious metals requires careful consideration of market trends, supply and demand factors, and the inherent risks associated with the asset class.

Energy

Energy commodities include oil, natural gas, and other energy-related products. Investing in energy commodities can provide exposure to the global energy market and its price fluctuations. Energy commodities are influenced by various factors, including geopolitical events, supply and demand dynamics, and macroeconomic conditions. Investors can gain exposure to energy commodities through futures contracts, ETFs, and other exchange-traded products. However, investing in energy commodities carries risks related to commodity price volatility and the potential impact of geopolitical events on the energy sector.

Agricultural

Agricultural commodities consist of crops, livestock, and other agricultural products. Investing in agricultural commodities can offer exposure to the global agriculture industry, which is influenced by factors such as weather conditions, crop diseases, and demand for food. Agricultural commodities can be accessed through futures contracts, ETFs, and other investment vehicles. Investing in agricultural commodities requires careful monitoring of supply and demand trends, crop reports, and global macroeconomic factors that can impact agricultural markets.

Industrial and Base Metals

Industrial and base metals, such as copper, aluminum, nickel, and zinc, are widely used in various industrial sectors, including construction, manufacturing, and transportation. Investing in industrial and base metals can provide exposure to global economic growth and infrastructure development. The prices of these metals are influenced by factors such as supply and demand imbalances, global economic conditions, and geopolitical events. Investors can access industrial and base metals through futures contracts, ETFs, and other investment vehicles. Investing in industrial and base metals carries risks associated with commodity price volatility and the cyclical nature of industrial sectors.

This image is property of www.wallstreetmojo.com.

Cryptocurrencies

Bitcoin

Bitcoin is the first and most well-known cryptocurrency, created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin operates on a decentralized network called blockchain and is not controlled by any central authority. Bitcoin has gained widespread acceptance as both a digital currency and a speculative investment. Investing in bitcoin involves buying and holding the cryptocurrency in digital wallets or trading it on cryptocurrency exchanges. Bitcoin is known for its high volatility, making it a potentially lucrative but risky investment.

Ethereum

Ethereum is an open-source blockchain platform that enables the creation and execution of smart contracts and decentralized applications (DApps). It was created in 2015 by Vitalik Buterin and has gained popularity for its versatility and potential applications beyond digital currency. Ether (ETH) is the native cryptocurrency of the Ethereum platform and is used to power transactions and incentivize participants in the Ethereum ecosystem. Investing in Ethereum involves buying and holding ether tokens or participating in the development of DApps on the Ethereum platform.

Ripple

Ripple is both a digital payment protocol and a cryptocurrency (XRP) created in 2012. Ripple aims to enable fast and low-cost international money transfers and has gained traction among financial institutions for its potential to streamline cross-border transactions. Investing in Ripple involves buying and holding XRP tokens or using Ripple’s payment protocol for international remittances. Ripple’s unique consensus algorithm and partnerships with financial institutions contribute to its appeal but also introduce certain risks and uncertainties.

Litecoin

Litecoin is a peer-to-peer cryptocurrency created in 2011 by Charlie Lee, a former Google engineer. It was designed to complement Bitcoin by offering faster transaction confirmation times and a different hashing algorithm. Litecoin shares many similarities with Bitcoin but has a higher maximum supply and different block generation time. Investing in Litecoin involves buying and holding LTC tokens or trading them on cryptocurrency exchanges. Litecoin’s market position as one of the oldest and most established cryptocurrencies contributes to its appeal among investors.

Foreign Exchange (Forex)

Major Currency Pairs

Major currency pairs in the forex market consist of the most actively traded currencies worldwide. These pairs include the U.S. dollar (USD) paired with other major currencies such as the euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss franc (CHF), Canadian dollar (CAD), and Australian dollar (AUD). Investing in major currency pairs involves speculating on the relative strength or weakness of one currency against another. Forex trading offers opportunities to profit from exchange rate fluctuations but also carries significant risk due to high leverage and market volatility.

Minor Currency Pairs

Minor currency pairs, also known as cross-currency pairs, consist of currencies that do not include the U.S. dollar as one of the paired currencies. Examples of minor currency pairs include the euro against the Japanese yen (EUR/JPY), the British pound against the Swiss franc (GBP/CHF), and the Australian dollar against the Canadian dollar (AUD/CAD). Investing in minor currency pairs allows investors to diversify their forex portfolio and take advantage of specific currency movements. Trading minor currency pairs can be more volatile and less liquid compared to major currency pairs.

Exotic Currency Pairs

Exotic currency pairs are less commonly traded currency pairs that involve emerging market currencies or currencies from smaller economies. Examples of exotic currency pairs include the Mexican peso (MXN), South African rand (ZAR), Thai baht (THB), and Turkish lira (TRY). Investing in exotic currency pairs carries higher risks compared to major or minor currency pairs due to lower liquidity, wider spreads, and higher volatility. Exotic currency pairs are popular among experienced forex traders who seek opportunities for potentially higher returns but are willing to accept greater risks.