If you’ve ever wondered how much money you need to start investing, you’re not alone. This question can be on the minds of many people who are eager to dip their toes into the world of investing but are unsure of where to begin. Luckily, we’re here to shed some light on this topic. In this article, we’ll provide you with historical charts and clear explanations to give you a better understanding of how much money you need to get started. Additionally, we’ll even provide reference links to popular investment broker sites that can help kickstart your investment journey. So, if you’ve been contemplating taking the leap into the world of investing, keep reading to find out the answer to the question: “How much money do I need to start investing?”

This image is property of momanddadmoney.com.

Factors to Consider Before Investing

Before diving into the world of investing, there are several important factors that you should consider. These factors will help guide your investment decisions and ensure that you are making choices that align with your goals and financial capabilities.

Determining Your Investment Goals

The first step in the investment process is to determine your investment goals. What are you looking to achieve with your investments? Are you saving for retirement, a down payment on a house, or simply growing your wealth over the long term? Defining your investment goals will give you direction and help you make informed decisions along the way.

Considering your Financial Situation

Next, you need to assess your financial situation. Take a good look at your income, expenses, and overall financial health. Are you able to set aside funds for investment purposes without compromising your day-to-day living expenses? It’s crucial to have a clear understanding of your financial situation before investing, as this will dictate the amount of money you can allocate towards your investment goals.

Assessing Your Risk Tolerance

Investing always involves some degree of risk, and it’s important to assess your risk tolerance before entering the market. Risk tolerance refers to your ability to withstand fluctuations in the value of your investments and your willingness to take on risk in pursuit of higher returns. Factors such as your age, financial goals, and personal comfort with volatility will all influence your risk tolerance. Understanding your risk tolerance will help you create an investment strategy that aligns with your comfort level.

Types of Investments

Now that you have a better understanding of the factors to consider before investing, let’s explore the various types of investments available to you. Each investment option carries its own set of characteristics, risks, and potential returns.

Stocks

Stocks, also known as equities, represent ownership in a company. When you purchase stocks, you become a shareholder in that company and have the potential to benefit from its growth and profitability. However, stocks are also subject to market volatility and can experience significant price fluctuations. It’s essential to research and choose stocks wisely, taking into account factors such as company performance, industry trends, and market conditions.

Bonds

Bonds are debt securities issued by governments, municipalities, and corporations. When you invest in bonds, you are essentially lending money to the bond issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered lower-risk investments compared to stocks, but their returns may be relatively modest. Factors such as credit rating, interest rate environment, and the issuer’s financial health can impact the performance of bonds.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer an accessible way for individuals to gain exposure to a broad range of securities without the need for extensive research or individual stock selection. However, keep in mind that mutual funds charge fees and expenses that can impact your returns.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they offer investors exposure to a diversified portfolio of securities. However, ETFs trade on stock exchanges just like individual stocks. This means that their prices can fluctuate throughout the trading day, unlike mutual funds, which are priced at the end of each trading day. ETFs are known for their flexibility, low costs, and tax efficiency.

Real Estate

Investing in real estate involves purchasing properties with the intention of generating income and/or capital appreciation. Real estate can take various forms, including residential properties, commercial properties, and real estate investment trusts (REITs). Real estate investments can provide a steady income stream through rental income, and the value of properties can appreciate over time. However, real estate investments typically require substantial upfront capital, ongoing maintenance costs, and careful market analysis.

Certificates of Deposit (CDs)

A certificate of deposit (CD) is a time deposit offered by banks and credit unions. When you invest in a CD, you agree to leave your money in the account for a specific period of time, known as the term, in exchange for a fixed interest rate. CDs are considered low-risk investments as they are insured by the FDIC (Federal Deposit Insurance Corporation) up to certain limits. However, they typically offer lower returns compared to other investment options.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that rely on encryption techniques for secure transactions. The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies available. Investing in cryptocurrencies can be highly volatile and speculative, with the potential for substantial gains or losses. It’s crucial to thoroughly research and understand the technology, market trends, and risks associated with cryptocurrencies before considering them as an investment option.

This image is property of www.fillingthepig.com.

Investment Account Types

Now that you have a grasp of the different investment options, it’s important to understand the various investment account types available to you. These accounts provide a framework for managing and growing your investments in a tax-efficient manner.

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts, or IRAs, are tax-advantaged retirement accounts that allow individuals to save for retirement. There are two main types of IRAs: Traditional IRAs and Roth IRAs. Contributions to Traditional IRAs may be tax-deductible, while contributions to Roth IRAs are made with after-tax dollars. Both types of IRAs offer potential tax advantages, but they have different rules regarding contributions, withdrawals, and taxation.

401(k)s

A 401(k) is a retirement savings plan typically offered by employers. Employees can contribute a portion of their pre-tax income to the plan, and many employers also provide matching contributions. 401(k)s offer the opportunity for tax-deferred growth, meaning contributions and investment earnings are not subject to income tax until withdrawn in retirement. However, there are contribution limits, withdrawal restrictions, and potential penalties for early withdrawals.

Taxable Brokerage Accounts

Taxable brokerage accounts are investment accounts that are not specifically designated for retirement savings. These accounts allow you to invest in a wide range of assets, such as stocks, bonds, mutual funds, and ETFs. Unlike retirement accounts, contributions to taxable brokerage accounts are made with after-tax dollars. While these accounts do not offer the same tax benefits as retirement accounts, they provide more flexibility in terms of contributions and withdrawals.

Simplified Employee Pension (SEP) IRAs

SEP IRAs are retirement savings plans for self-employed individuals or small business owners. Contributions to SEP IRAs are tax-deductible and grow tax-deferred until retirement. SEP IRAs offer higher contribution limits compared to Traditional or Roth IRAs, making them an attractive option for self-employed individuals looking to maximize their retirement savings.

Roth IRAs

As mentioned earlier, Roth IRAs are individual retirement accounts that allow individuals to contribute after-tax dollars. Roth IRAs offer tax-free growth and tax-free withdrawals in retirement, as long as certain conditions are met. They can be an excellent option for individuals who anticipate being in a higher tax bracket in retirement or want to minimize their future tax liability.

Determining the Minimum Investment Required

The minimum investment required for each investment option can vary significantly. It’s essential to consider your financial capabilities and investment goals when determining the amount of money you can allocate towards each investment.

Stocks

The minimum investment required for stocks can vary depending on the price of individual stocks and the brokerage platform you use. Some brokerage platforms offer the option to purchase fractional shares, allowing you to invest smaller amounts. However, keep in mind that commissions and fees may apply, so it’s important to factor in these costs when determining your minimum investment.

Bonds

Bonds can be purchased with various minimum investment amounts, depending on the issuer and the type of bond. Government bonds and corporate bonds may have different minimum investment requirements. It’s crucial to research the specific bond you are interested in to determine the minimum investment required.

Mutual Funds

The minimum investment required for mutual funds can vary significantly. Some mutual funds may have minimum investment requirements as low as a few hundred dollars, while others may require thousands of dollars to get started. It’s important to research different mutual funds and their minimum investment requirements to find options that align with your budget.

ETFs

ETFs generally do not have minimum investment requirements. However, you will need to purchase at least one share of the ETF, which will have its own purchase price. Like stocks, ETFs may also have commission fees associated with their purchase or sale.

Real Estate

Investing in real estate typically requires a larger upfront capital investment compared to other investment options. The minimum investment required will depend on the type of real estate investment and the specific property or investment vehicle you are considering. Real estate investments often involve significant financial commitments, such as down payments, closing costs, and ongoing maintenance expenses.

CDs

The minimum investment required for CDs can vary depending on the financial institution offering the CD. Some banks and credit unions may have minimum deposit requirements as low as $500, while others may require larger amounts. It’s advisable to shop around and compare different CD offerings to find one that suits your investment budget.

Cryptocurrencies

The minimum investment required for cryptocurrencies can be relatively low, as you can purchase a fraction of a cryptocurrency. However, keep in mind that investing in cryptocurrencies can be highly volatile and speculative. It’s important to approach cryptocurrency investments with caution and only invest what you can afford to lose.

This image is property of www.biggerpockets.com.

Platforms to Start Investing

Once you have determined your investment goals, investment options, and the minimum investment required, it’s time to explore the platforms available for starting your investment journey. Here are three common types of platforms to consider:

Online Brokerage Platforms

Online brokerage platforms provide individuals with the ability to buy and sell various investment assets, such as stocks, bonds, mutual funds, and ETFs, through an online interface. These platforms typically offer user-friendly interfaces, educational resources, and access to research tools. Online brokerage platforms are a popular choice for self-directed investors who want to take control of their investment decisions.

Robo-Advisors

Robo-advisors are online investment platforms that use algorithms to provide automated investment advice and portfolio management. When you invest with a robo-advisor, the platform will assess your risk tolerance, investment goals, and time horizon to create a diversified portfolio of ETFs or other low-cost investment options. Robo-advisors are an excellent option for individuals who prefer a hands-off approach to investing or who are just starting their investment journey.

Traditional Financial Advisors

Traditional financial advisors are professionals who offer personalized investment advice and financial planning services. They can help you develop an investment strategy, select suitable investment options, and manage your portfolio over time. Traditional financial advisors typically charge fees for their services, which can vary based on factors such as the size of your investment portfolio and the level of advice you require.

Costs and Fees

When investing, it’s important to be aware of the costs and fees associated with different investment products and platforms. These costs can impact your overall returns and should be considered when evaluating investment options.

Transaction Fees

Many brokerage platforms charge transaction fees for buying or selling certain investment products, such as individual stocks or mutual funds. These fees can vary depending on the platform and the specific transaction. It’s essential to understand the transaction fees associated with your chosen platform to avoid any surprises.

Management Fees

Some investment products, such as mutual funds and robo-advisor portfolios, charge ongoing management fees. These fees cover the costs of managing the investment and are typically expressed as a percentage of your invested assets. It’s important to consider management fees when evaluating the potential returns and long-term costs of an investment.

Expense Ratios

Expense ratios are another type of fee associated with mutual funds and ETFs. The expense ratio represents the annual operating expenses of the investment, expressed as a percentage of the fund’s average net assets. These expenses include costs such as management fees, administrative expenses, and marketing expenses. A lower expense ratio generally indicates a more cost-effective fund.

This image is property of i.ytimg.com.

Investing Strategies for Different Budgets

Investing is not limited to individuals with significant financial resources. Regardless of your budget, there are strategies you can employ to make the most of your investment journey.

Investing with Small Amounts

If you have a small amount of money to invest, there are several options available to you. Consider starting with low-cost investment products such as ETFs, which allow you to invest in a diversified portfolio without requiring a large upfront investment. You can also take advantage of automatic investment plans, such as dollar-cost averaging, which allows you to invest a fixed amount regularly, regardless of market conditions.

Investing with Moderate Amounts

If you have a moderate amount of money to invest, you can consider diversifying your investments across different asset classes and investment options. This can help spread the risk and potentially improve your returns over time. It’s also advisable to continue adding to your investments regularly and taking advantage of tax-advantaged accounts, such as IRAs, to maximize your long-term growth potential.

Investing with Larger Amounts

If you have a larger amount of money to invest, you may have more flexibility to explore additional investment opportunities. You can consider investing directly in real estate properties, exploring private equity or venture capital investments, or even hiring a financial advisor to create a customized investment strategy. However, it’s crucial to conduct thorough research and seek professional advice when dealing with significant investment amounts.

Additional Considerations

In addition to the factors already discussed, there are a few additional considerations that can have a significant impact on your investment journey.

Emergency Fund

Before diving into investments, it’s crucial to establish an emergency fund. An emergency fund provides a financial safety net, consisting of readily available cash that can be used in case of unexpected expenses or income disruption. Having an emergency fund in place will help ensure that you don’t need to liquidate your investments prematurely and can stay on track with your long-term financial goals.

Paying off High-Interest Debt

It’s generally advisable to prioritize paying off high-interest debt, such as credit card debt or personal loans, before investing. The interest rates charged on these debts are often higher than the potential returns you can earn from investments. By paying off high-interest debt, you can improve your financial health and free up more funds to invest in the future.

Diversification

Diversification is a risk management strategy that involves spreading your investments across different asset classes, industries, and geographical regions. By diversifying your portfolio, you can reduce the impact of any single investment on your overall portfolio performance. Diversification can help protect against market volatility and potentially increase your chances of long-term success.

Time Horizon

Your time horizon refers to the length of time you plan to invest your money before needing to access it. It’s an essential factor to consider when choosing investment options and determining the level of risk you are comfortable with. Longer time horizons generally allow for more aggressive investment strategies, while shorter time horizons may require more conservative approaches to protect capital.

This image is property of www.investverse.com.

Potential Risks and Rewards

Investing inherently involves risks, and it’s important to understand and manage these risks to maximize your potential rewards.

Understanding Investment Risks

Investment risks can take various forms, including market risk, credit risk, inflation risk, and liquidity risk, among others. Market risk refers to the potential for investment values to fluctuate due to economic or market conditions. Credit risk refers to the potential for bond issuers to default on their payments. Inflation risk refers to the decline in purchasing power over time due to rising prices. Liquidity risk refers to the potential difficulty in selling an investment quickly without incurring significant losses. It’s important to educate yourself about the risks associated with different investment options and ensure that your portfolio is adequately diversified.

Earning Potential in Investments

While investments carry risks, they also offer potential rewards in the form of returns. Historical data suggests that, over the long term, investments in assets such as stocks and real estate have outperformed other investment options, such as bonds or cash. However, past performance is not indicative of future results, and there is no guarantee of returns. It’s important to approach investments with a long-term perspective and manage your expectations accordingly.

Tips for Successful Investing

To increase your chances of success as an investor, here are a few tips to keep in mind:

Educate Yourself

Take the time to educate yourself about different investment options, strategies, and market trends. Stay informed by reading books, articles, and reputable financial websites. Consider taking investment courses or attending seminars to enhance your knowledge and confidence.

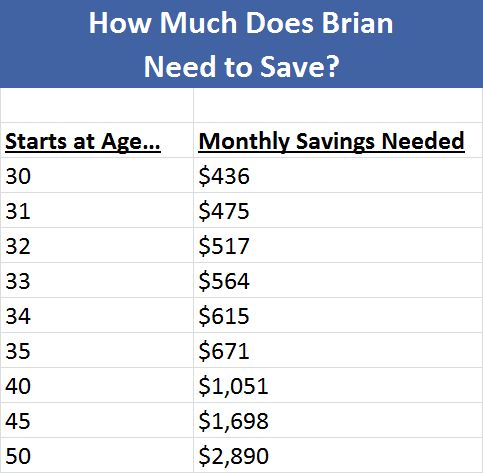

Start Early

The power of compounding makes starting early one of the most effective strategies for long-term wealth creation. By giving your investments more time to grow, you can potentially benefit from the exponential growth of your invested capital.

Set Realistic Expectations

Investing is a journey that requires patience and discipline. Set realistic expectations and focus on your long-term goals. Avoid making impulsive investment decisions based on short-term market fluctuations, as this can lead to poor outcomes.

Consider Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount of money, regardless of market conditions. By investing a fixed amount at regular intervals, you can buy more shares or units when prices are low and fewer shares or units when prices are high. This strategy can help mitigate the impact of market volatility and potentially improve your long-term returns.

Review and Adjust Your Portfolio Regularly

Investing is an ongoing process that requires periodic reviews and adjustments. Regularly review your investment portfolio to ensure that it continues to align with your goals, risk tolerance, and market conditions. Consider rebalancing your portfolio if certain investments have become over- or underweighted.

In conclusion, investing can be a powerful tool for growing your wealth and achieving your long-term financial goals. By considering factors such as your investment goals, financial situation, and risk tolerance, you can make informed decisions about the types of investments and investment accounts that suit your needs. Remember to start with a small amount, educate yourself, and regularly review your portfolio to increase your chances of success. With patience, discipline, and a long-term perspective, you can embark on a successful investment journey.