Are you wondering which investment strategies are the most effective for securing a comfortable retirement? Look no further! In this article, we will discuss some tried and true methods that can help you make the most of your savings and ensure a financially stable future. Whether you’re just starting to plan for retirement or are already well on your way, these strategies are designed to assist you in achieving your goals. So sit back, relax, and let’s dive into the world of retirement investments.

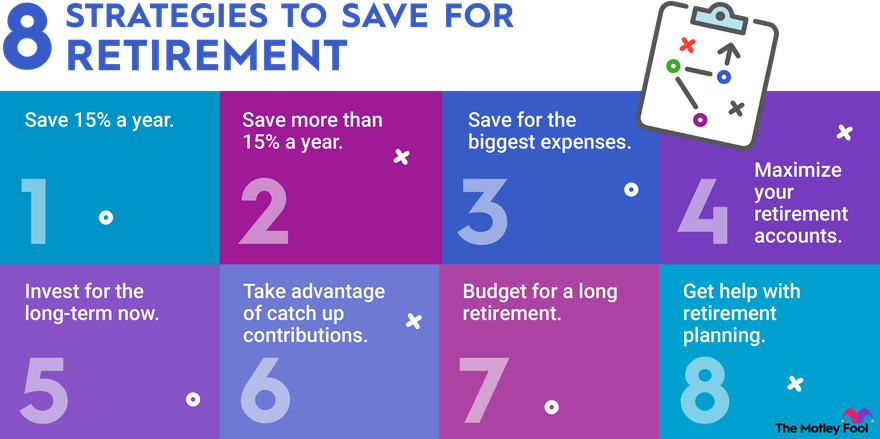

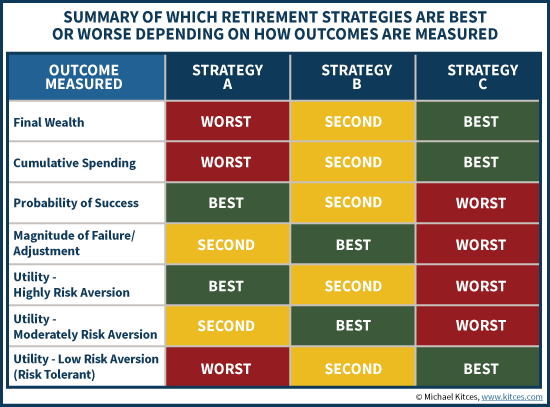

This image is property of m.foolcdn.com.

Planning for Retirement

Retirement is an exciting phase of life, where you can finally enjoy the fruits of your labor and pursue the activities you love without the constraints of work. However, in order to make the most of your retirement, it’s crucial to plan ahead and set clear goals. Determining your retirement goals is the first step in ensuring a financially secure and fulfilling retirement.

Determining Retirement Goals

When it comes to planning for retirement, it’s important to have a clear understanding of what you want to achieve. Take some time to consider the lifestyle you envision for your retirement years. Do you plan on traveling extensively, pursuing hobbies, or starting a new business venture? By identifying your retirement goals, you can better estimate the amount of money you will need to save and invest.

Assessing Risk Tolerance

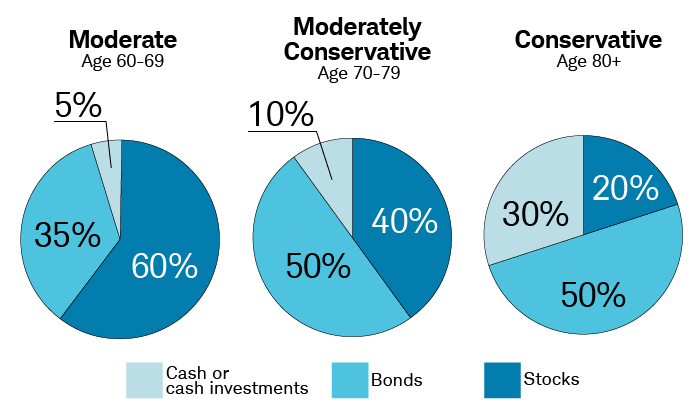

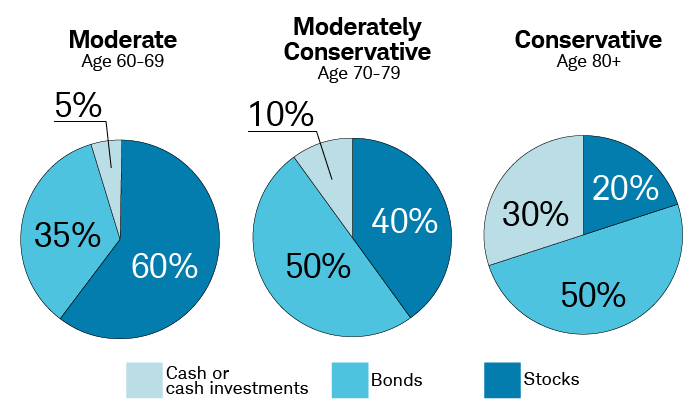

Another important aspect of retirement planning is assessing your risk tolerance. Risk tolerance refers to your ability to withstand fluctuations in the value of your investments. While higher-risk investments may offer the potential for greater returns, they also come with a higher likelihood of volatility. On the other hand, lower-risk investments generally generate more stable returns but may not provide the growth necessary to meet your retirement goals. It’s essential to strike a balance between risk and reward that aligns with your individual circumstances and comfort level.

Considering Time Horizon

When planning for retirement, it’s crucial to consider your time horizon – the number of years you have until you retire. Your time horizon will impact the investment strategies you choose. If you have a long time horizon, you may be able to afford a more aggressive investment approach, as you have time to weather short-term market fluctuations. Conversely, if you have a shorter time horizon, a more conservative investment strategy may be appropriate to protect your wealth and minimize the impact of market downturns.

Traditional Investment Strategies

Once you have a solid retirement plan in place, it’s time to explore different investment strategies that can help you grow your nest egg. Traditional investment strategies, such as stocks, bonds, mutual funds, and index funds, have proven to be effective ways of building wealth over time.

Stocks and Bonds

Investing in stocks and bonds can play an integral role in a retirement portfolio. Stocks represent ownership in a company and offer the potential for capital appreciation and dividends. On the other hand, bonds are debt instruments issued by governments and corporations to raise capital. Bonds provide regular interest payments and return the principal amount at maturity. Both stocks and bonds carry risks, but when chosen wisely and diversified, they can provide reliable returns over the long term.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. The advantage of investing in mutual funds is that they provide instant diversification and are managed by seasoned professionals. This makes it an attractive option for retirement investors who may not have the time or expertise to select and manage individual securities.

Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500. Index funds offer broad market exposure and are known for their low fees and passive management style. By investing in index funds, you can gain exposure to a wide range of stocks or bonds and benefit from the overall growth of the market.

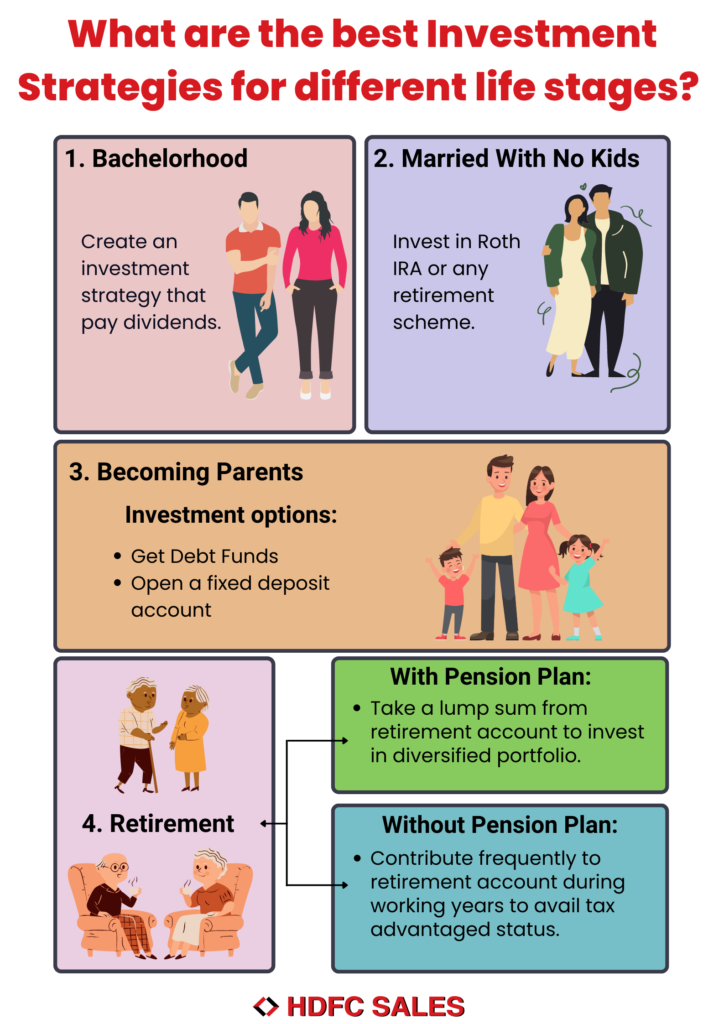

This image is property of www.hdfcsales.com.

Diversification

Diversification is a crucial strategy that can help mitigate risk and optimize returns in your retirement portfolio. By spreading your investments across different asset classes and geographic regions, you can reduce the impact of any one investment’s poor performance on your overall portfolio.

Importance of Diversification

Diversification is often referred to as the only free lunch in investing. It is a strategy that allows you to potentially earn consistent returns while minimizing the impact of market volatility. By investing in a mix of asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the risk associated with any single investment. Remember, the key is to find the right balance between risk and diversification that aligns with your goals and risk tolerance.

Asset Allocation

Asset allocation is the process of deciding how much of your portfolio should be invested in different asset classes. It involves determining the percentage allocation to stocks, bonds, and other investments based on your risk tolerance, goals, and time horizon. Asset allocation allows you to tailor your portfolio to your specific needs, ensuring that you have an appropriate mix of investments to achieve your retirement goals.

Rebalancing

Rebalancing is an important aspect of maintaining a diversified portfolio. Over time, the performance of different asset classes and investments may deviate from their target allocation. Rebalancing involves periodically adjusting your portfolio back to its original asset allocation. By rebalancing, you can sell assets that have appreciated in value and buy assets that have declined, thereby maintaining your desired risk level and ensuring that your portfolio remains aligned with your long-term goals.

Passive vs Active Investing

When it comes to investing for retirement, you have two primary approaches to choose from: passive investing and active investing. Both strategies have their own merits and drawbacks, and the right approach for you depends on your personal preferences and investment goals.

Passive Investing

Passive investing aims to replicate the performance of a specific market index or asset class instead of trying to outperform it. This strategy involves investing in index funds or ETFs that track a particular benchmark. The main advantage of passive investing is the lower fees associated with index funds, as they require less active management. It also allows you to benefit from broader market growth rather than relying on individual stock-picking.

Active Investing

Active investing, on the other hand, involves actively selecting and managing individual stocks or securities with the goal of outperforming the market. This strategy requires more time and effort, as it involves conducting research, analyzing companies, and making investment decisions based on market trends and fundamentals. Active investing can offer the potential for higher returns, but it also comes with higher expenses and the risk of underperforming the market.

Combining Passive and Active Strategies

Many retirement investors opt for a combination of passive and active investment strategies to strike a balance between risk and reward. This approach involves allocating a portion of your portfolio to low-cost index funds or ETFs for broad market exposure, while also dedicating a portion to actively managed funds or individual stocks for potential outperformance. By combining both strategies, you can benefit from the advantages of passive investing while leveraging the potential of active management.

This image is property of www.schwab.com.

Investing in Individual Stocks

Investing in individual stocks gives you the opportunity to become a partial owner of a company and directly participate in its success. While investing in individual stocks can be rewarding, it requires careful research and monitoring to ensure that you make informed investment decisions.

Researching Companies

Before investing in individual stocks, it’s essential to conduct thorough research on the companies you are considering. This involves analyzing financial statements, examining the company’s competitive position, and evaluating its growth prospects. It’s also important to consider factors such as the company’s management team, industry trends, and potential risks. By doing your due diligence, you can make informed investment decisions and select companies with a strong likelihood of long-term success.

Executing a Buy-and-Hold Strategy

A buy-and-hold strategy involves investing in stocks with the intention of holding them for an extended period, typically years or even decades. This strategy is based on the belief that a well-chosen stock will increase in value over time, and short-term market fluctuations should not deter long-term investors. By adopting a buy-and-hold strategy, you can benefit from the compounding effect and potentially generate significant returns over the course of your retirement savings journey.

Managing Risk

While investing in individual stocks can be rewarding, it also carries inherent risks. The value of stocks can fluctuate significantly based on market conditions, company-specific factors, or broader economic trends. To manage risk, it’s important to diversify your stock portfolio by investing in a range of companies across different industries. This can help mitigate the impact of any one stock’s poor performance on your overall portfolio. Additionally, regularly reviewing and monitoring your investments can help identify any potential red flags or changes in the company’s fundamentals that may warrant adjustments to your portfolio.

Investing in Real Estate

Real estate has long been considered a lucrative investment avenue for retirement planning. Investing in real estate provides you with the opportunity to generate rental income, benefit from property appreciation, and diversify your investment portfolio.

Buy-to-Rent Properties

One popular real estate investment strategy is investing in buy-to-rent properties. This involves purchasing residential or commercial properties with the intention of leasing them out to tenants. Rental income can provide a steady cash flow that can supplement your retirement income, while property appreciation can result in significant wealth accumulation over time. However, investing in real estate requires careful consideration of factors such as location, market trends, property management, and potential rental demand.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are another option for individuals looking to invest in real estate without the hassle of property ownership. REITs are companies that own and manage income-generating real estate properties, such as office buildings, apartments, or shopping centers. By investing in REITs, you can gain exposure to the real estate market and benefit from rental income and property appreciation without directly owning and managing properties. REITs are traded on exchanges and provide liquidity, making them a convenient option for retirement investors.

Flipping Properties

Flipping properties refers to buying properties at a low price, renovating or improving them, and selling them at a higher price for a profit. This strategy requires knowledge of the local real estate market, the ability to identify undervalued properties, and the skills to manage renovations effectively. Flipping properties can be a high-risk, high-reward investment strategy, as success largely depends on market conditions, timing, and the ability to renovate properties at a reasonable cost. It’s important to carefully assess the potential costs and returns before embarking on a flipping strategy.

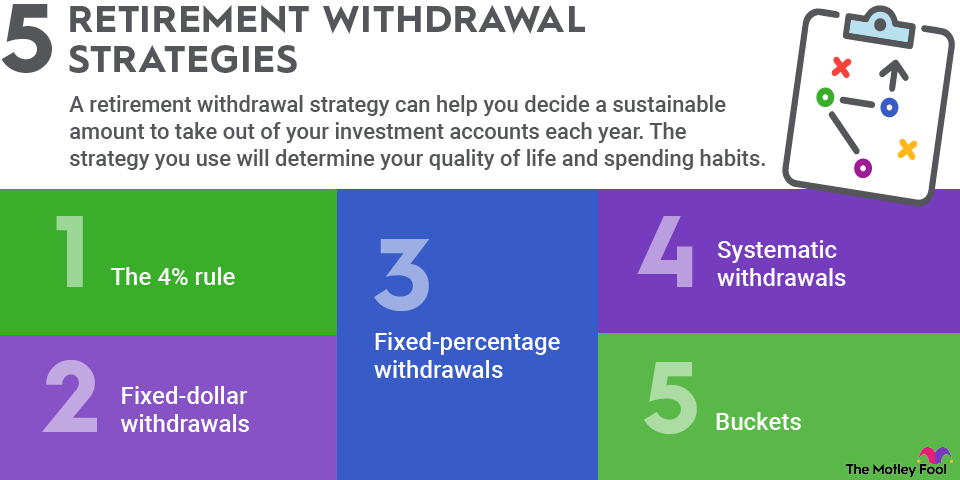

This image is property of www.kitces.com.

Investing in Bonds

Investing in bonds is another viable strategy for retirement investors looking for more stability and predictable income. Bonds are debt instruments issued by governments, corporations, or municipalities to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Government Bonds

Government bonds, also known as Treasury bonds, are issued by the government to finance its operations and infrastructure projects. They are considered one of the safest investment options, as they are backed by the full faith and credit of the issuing government. Government bonds offer fixed interest payments and are known for their low default risk. They can provide retirement investors with a stable source of income and serve as a hedge against stock market volatility.

Corporate Bonds

Corporate bonds are issued by companies to raise capital for expansion, acquisitions, or other business activities. These bonds offer higher interest rates than government bonds, reflecting the higher default risk associated with corporate issuers. Corporate bonds are a suitable option for retirement investors seeking higher yields and are willing to accept a moderate level of risk. It’s important to carefully analyze the creditworthiness of the issuing company and consider factors such as industry trends, financial stability, and debt levels before investing in corporate bonds.

Municipal Bonds

Municipal bonds, or munis, are issued by state and local governments to finance public infrastructure projects, such as schools, hospitals, and transportation systems. The main advantage of investing in municipal bonds is that they are generally exempt from federal income taxes and may also be exempt from state and local taxes for investors residing in the issuing municipality. Municipal bonds offer retirement investors a tax-efficient investment option with relatively lower default risk compared to corporate bonds. It’s important to assess the financial health of the issuing municipality and evaluate the bond’s credit quality before investing.

Investing in Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors. This makes mutual funds a convenient and popular option for retirement investors looking for diversification and professional management.

Choosing the Right Fund

When investing in mutual funds, it’s important to choose the right fund that aligns with your investment goals and risk tolerance. There are various types of mutual funds available, such as equity funds, bond funds, balanced funds, and target-date funds. Equity funds invest primarily in stocks, while bond funds focus on fixed-income securities. Balanced funds offer a mix of stocks and bonds, while target-date funds automatically adjust the allocation of assets based on the investor’s target retirement date. It’s crucial to carefully analyze the fund’s investment strategy, performance history, expense ratios, and the fund manager’s track record before making an investment.

Examining Expense Ratios

Expense ratios are an important factor to consider when investing in mutual funds. The expense ratio represents the percentage of a fund’s assets that are deducted annually to cover the fund’s operating expenses. A high expense ratio can significantly eat into your investment returns over time, while a low expense ratio can help maximize your investment gains. It’s advisable to choose mutual funds with expense ratios that are competitive within their respective categories and align with the value provided by the fund manager.

Evaluating Fund Managers

Fund managers play a crucial role in the performance of mutual funds. Their investment decisions and strategies directly impact the fund’s returns. When evaluating mutual funds, it’s important to assess the track record and experience of the fund manager. Look for managers who have consistently delivered strong performance over the long term and have a sound investment philosophy that aligns with your investment goals. Additionally, consider the stability of the fund management team and whether they have a disciplined approach to managing risk.

This image is property of m.foolcdn.com.

Investing in Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) have gained popularity among retirement investors due to their cost-effectiveness, flexibility, and ease of trading. ETFs are similar to mutual funds but trade on stock exchanges like individual stocks.

Understanding ETFs

ETFs are investment funds that hold a basket of securities, such as stocks, bonds, or commodities, and aim to replicate the performance of a specific market index or asset class. ETFs offer broad market exposure and can be traded throughout the trading day, providing flexibility to buy or sell shares at market prices. The underlying securities of an ETF are typically chosen to closely track a specific index, sector, or asset class.

Benefits of ETFs

ETFs offer several benefits for retirement investors. Firstly, they provide instant diversification by holding a portfolio of securities within a single investment. This diversification helps reduce the risk associated with any one stock or bond and provides exposure to a wide range of companies or assets. Secondly, ETFs have lower expense ratios compared to many mutual funds, making them a cost-effective investment option. Finally, the ease of trading ETFs on stock exchanges allows investors to buy or sell shares at market prices throughout the trading day, providing liquidity and flexibility.

Choosing the Right ETF

When choosing ETFs for your retirement portfolio, it’s important to consider several factors. Start by determining the asset class or market segment you want to invest in, such as U.S. stocks, international stocks, bonds, or commodities. Research and compare different ETF providers and evaluate the fund’s expense ratio, tracking error, liquidity, and historical performance. It’s also important to consider the fund’s size and popularity to ensure it has sufficient assets under management and trading volume.

Seeking Professional Advice

While you can certainly manage your retirement investments independently, seeking professional advice can provide you with valuable insights, expertise, and peace of mind. Financial advisors, robo-advisors, and certified financial planners are professionals who can assist you in making informed decisions and developing a comprehensive retirement investment strategy.

Financial Advisors

Financial advisors are professionals who provide personalized investment advice tailored to your individual goals, risk tolerance, and financial needs. They can help you develop a retirement plan, assess your risk tolerance, and recommend suitable investment strategies. Financial advisors can also provide ongoing portfolio management, monitor your investments, and make adjustments as necessary. When choosing a financial advisor, consider their qualifications, experience, and fee structure to ensure they are aligned with your requirements.

Robo-Advisors

Robo-advisors are digital platforms that use algorithms to provide automated investment advice and portfolio management. They offer a cost-effective solution for retirement investors who prefer a hands-off approach and want access to professional investment management without the high fees associated with traditional financial advisors. Robo-advisors typically assess your risk tolerance and investment goals through an online questionnaire and create a diversified portfolio of ETFs based on your preferences.

Certified Financial Planner (CFP)

Certified Financial Planners (CFPs) are financial professionals who have met the rigorous education, experience, and ethical requirements set by the Certified Financial Planner Board of Standards. CFPs can provide comprehensive financial planning advice, including retirement planning, investment management, tax planning, estate planning, and risk management. Working with a CFP can provide you with holistic financial guidance and peace of mind, knowing that your retirement investments are aligned with your overall financial goals.

In conclusion, planning for retirement requires careful consideration of your goals, risk tolerance, and time horizon. Traditional investment strategies such as stocks, bonds, mutual funds, and index funds can help you build wealth over time. Diversification, through asset allocation and regular rebalancing, helps mitigate risk and optimize returns. Understanding the difference between passive and active investing can help you decide on the appropriate investment strategy. Investing in individual stocks, real estate, bonds, mutual funds, and ETFs offers various avenues for retirement investors to explore. Seeking professional advice from financial advisors, robo-advisors, or certified financial planners can provide you with the expertise needed to make informed investment decisions. By taking a comprehensive approach to retirement investing, you can set yourself up for a financially secure and fulfilling retirement.